Financial and Compliance Audit of the Department of Hawaiian Home Lands

Posted on Mar 27, 2020 in Summary|

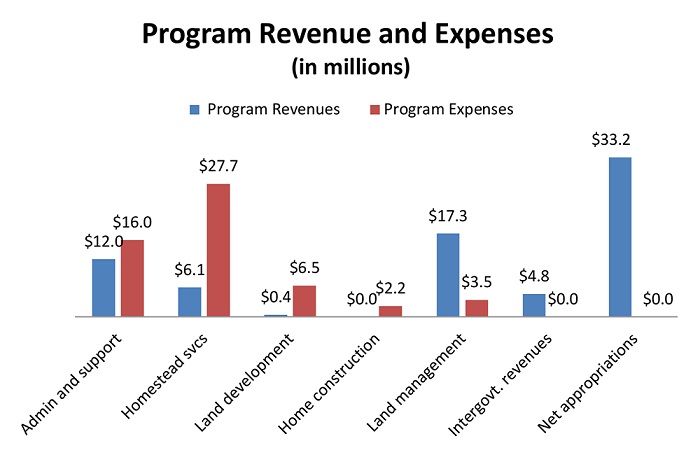

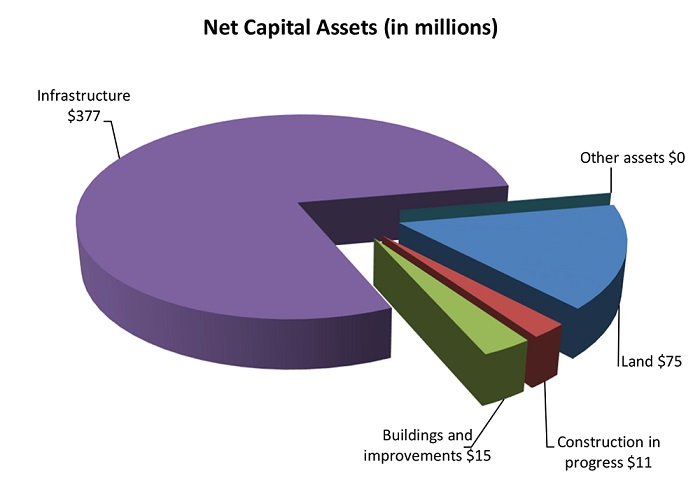

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2019 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Hawaiian Home Lands, as of and for the fiscal year ended June 30, 2019, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by Akamine, Oyadomari & Kosaki CPA’s Inc. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2019, DHHL’s total revenues exceeded total expenditures by $18.1 million. Revenues totaled $73.8 million and consisted of (1) program revenue of $40.6 million and (2) state appropriations, transfers, and adjustments of $33.2 million. Expenses totaled $55.7 million. Program revenues were comprised of interest income (approximately 27 percent), grants and contributions (11 percent), revenue from the general lease program (43 percent), and other sources (19 percent). As of June 30, 2019, total assets of $986 million exceeded total liabilities of $100 million, resulting in a net position balance of $886 million. Total assets included net capital assets of $479 million, cash of $370 million, loans receivable of $94 million, and other assets and deferred outflows of resources of $43 million. Loans receivable consisted of 1,336 loans made to native Hawaiian lessees for the purposes specified in the Hawaiian Homes Commission Act. Loans are for a maximum amount of approximately $453,000 and for a maximum term of 30 years. Interest rates on outstanding loans range up to 10 percent. Total liabilities included notes, bonds, and capital lease obligations totaling $52 million and temporary deposits payable and other liabilities of $48 million. Auditors’ Opinion DHHL RECEIVED AN UNMODIFIED OPINION that the financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. DHHL also received an unmodified opinion on its compliance with major federal programs in accordance with the Uniform Guidance. Findings THERE WERE NO REPORTED DEFICIENCIES in internal control over financial reporting that are considered to be material weaknesses and no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards. There were no findings that are considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. |

| About the Department

The Hawaiian Homes Commission Act sets aside certain public lands as Hawaiian home lands to be utilized in the rehabilitation of native Hawaiians. These public lands are managed by the Department of Hawaiian Home Lands (DHHL), a state agency headed by the Hawaiian Homes Commission, whose primary responsibilities are to serve its beneficiaries and to manage this extensive land trust. DHHL provides direct benefits to native Hawaiians in the form of 99-year homestead leases at $1 per year for residential, agricultural, or pastoral purposes, and financial assistance through direct loans, insured loans, or loan guarantees for home purchase, construction, home replacement, or repair. In addition to administering the homesteading program, DHHL leases trust lands not in homestead use at market value and issues revocable permits, licenses, and rights-of-entry. Its financial statements include the public trusts controlled by the Hawaiian Homes Commission. |