Photo: istock.com AUDITOR’S SUMMARY

SECTION 342G-17, Hawai‘i Revised Statutes, requires the Office of the Auditor to conduct a management and financial audit of the Deposit Beverage Container Program (Program) in fiscal years ending in even numbers. This financial and program audit for fiscal year ended June 30, 2020 was conducted by the certified public accounting firm of KMH LLP with the assistance of the Office of the Auditor.

What Did We Find? We have repeatedly expressed concerns about the Program’s reliance on self-reported data from distributors and redemption centers, explicitly stating that the Department of Health’s (DOH) passive oversight exposes the Program to possible fraud, waste, and abuse. During an initial meeting with the department, management conceded that they had not addressed any of our previous audit findings, despite the actual fraud that was reported in 2018. DOH’s administration of the Program continues to rely on self-reported information. Without any controls in place – i.e., policies, procedures, or processes – we could not audit the department’s performance of its statutory responsibilities, and the Program continues to be at risk of fraud, waste, and abuse.

As a result, we redirected this year’s review to ascertain and report why DOH has failed to address the long-standing findings that have been repeated for years. Our review primarily consisted of a series of interviews with DOH and Program management, including the then-Deputy Director of Environmental Health, the Solid and Hazardous Waste Branch Chief, the Solid Waste Coordinator, and the Recycling Coordinator.

During this review, the Solid Waste Coordinator described a “compliance testing pilot project” the Coordinator had started in July 2020 to cross-reference customer-signed receipts with redemption center daily reports

and the forms submitted to request reimbursement of the redemption amounts paid to consumers. According to the Solid Waste Coordinator,

if successful, Program staff would review and cross-reference one redemption center’s records per quarter. As of June 30, 2020, there were

62 redemption centers in the state, meaning it would take Program staff more than 15 years to complete testing of every redemption center. In our next audit of the Program, we will likely assess this and other improvements to the Program that the department represents it had started subsequent to our current audit.

Why Did These Problems Occur? DOH and Program management have taken no substantive actions to address the prior audit findings, including any measures to identify and prevent the type of fraud that we reported in 2019. DOH’s disinterest or reluctance to properly administer the Program may be because management does not believe the Program should be its responsibility. According to the Deputy Director for Environmental Health at the time, the prior DOH Director believed that the department should not be administering the Program in the first place and that those duties should be contracted out. However, administration of the Program is a department responsibility, and until the Legislature amends that responsibility, DOH must be accountable for the Program’s shortcomings. DOH and Program management must prioritize addressing the audit findings and other Program improvements; starting with the DOH director, they must clearly convey the importance and urgency of addressing the Program shortcomings to other managers and Program staff.

Why Do These Problems Matter?

In prior audits, we performed very limited testing of distributors and redemption centers’ compliance with their respective statutory requirements. We found many instances where distributors and redemption centers have improperly enriched themselves – whether intentionally or not – because of the department’s lack of controls and its passive administration. And, because DOH is entirely reliant on distributors to self-report the number of containers sold, and on redemption centers to self-report the number of containers redeemed, there is both incentive and opportunity to continue to do so.

In addition, the moneys that the Program collects are the deposits and handling fees collected from consumers that are held in a fund for those consumers who redeem the containers at redemption centers. While the number of containers that consumers redeem continues to decline (which means the fund continues to grow), DOH is accountable for the deposits and handling fees. Should the Program ever run short of funds, taxpayers would be – but should not be – responsible for reimbursing the amounts redemption centers pay to consumers who redeem their containers.

If the department believes that the administration of the Program is not aligned with its current capabilities, it should hire a third-party to administer the Program, which the statute expressly allows. Whether through a third-party or its own staff, we recommend DOH take immediate action to address the deficiencies in the administration of the Program that have been repeatedly identified in prior reports. |

Financial Audit of the Department of Health, Deposit Beverage Container Deposit Special Fund

Financial Statements, Fiscal Year Ended June 30, 2020

Financial Highlights

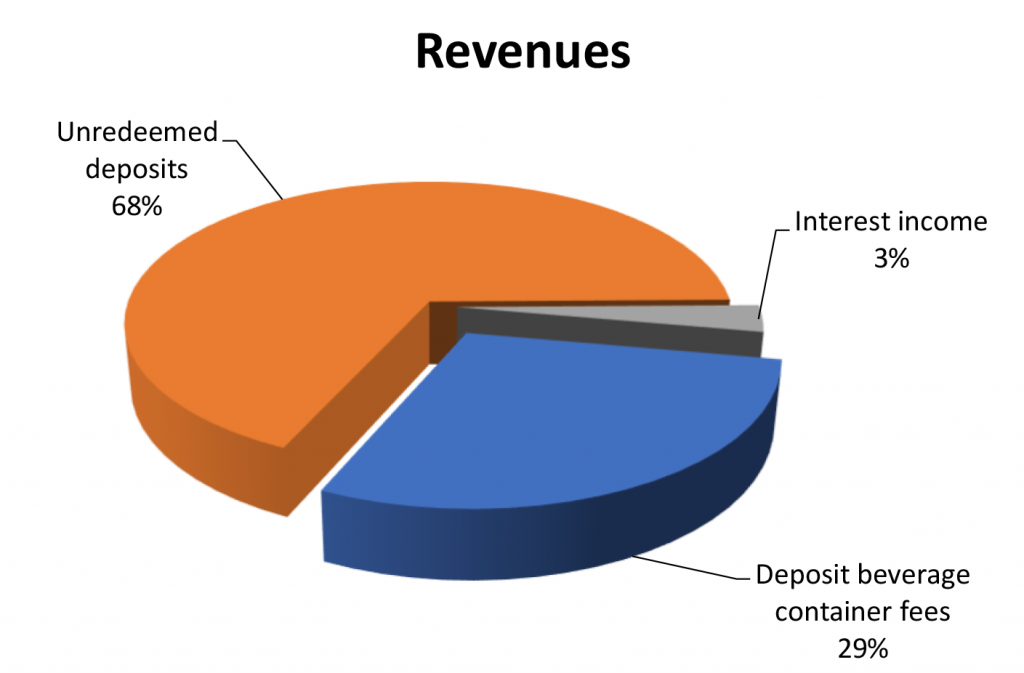

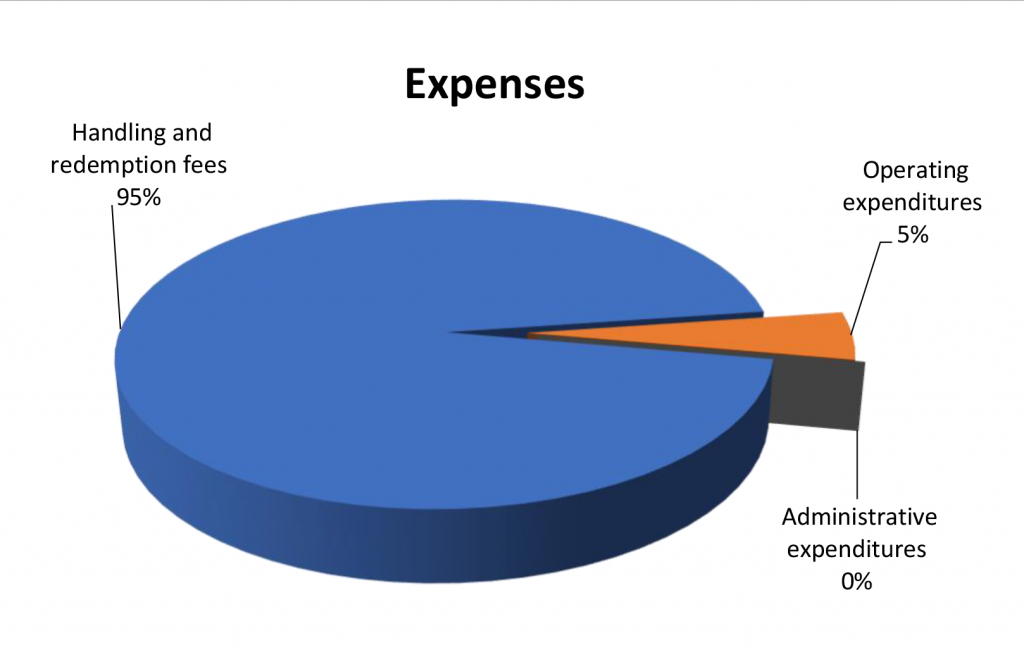

For the fiscal year ended June 30, 2020, the Deposit Beverage Container Deposit Special Fund (Fund) reported total revenues of $27.66 million and total expenditures of $21.94 million, resulting in a change in fund balance

of $5.72 million. Total revenues consisted of (1) deposit beverage container fees of $7.92 million, (2) unredeemed deposits of $18.86 million, and

(3) interest income of $870,000. Total expenditures consisted of (1) handling and redemption fees of $20.71 million, (2) operating expenditures of

$1.17 million, and (3) administrative expenditures of $50,000.

As of June 30, 2020, total assets were $55.91 million and total liabilities were $5.58 million. Total assets were comprised of (1) cash and cash equivalents of $55.65 million, (2) accounts receivable of $170,000, and

(3) interest receivable of $90,000. Total liabilities were comprised of

(1) vouchers and contracts payable of $3.3 million, (2) beverage container deposits of $2.05 million, (3) unearned revenue of $200,000, and

(4) accrued wages and employee benefits of $30,000.

Auditors’ Opinions

The Fund received an unmodified opinion that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles.

Findings

There were no reported deficiencies in internal control over financial reporting that were considered to be material weaknesses and no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards. However, the auditors identified a significant deficiency in internal control. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. The significant deficiency is reported on page 40 of the report. |