23-07, Financial and Program Audit of the Department of Health’s Deposit Beverage Container Program, June 30, 2022

Posted on Jun 23, 2023 in Summary|

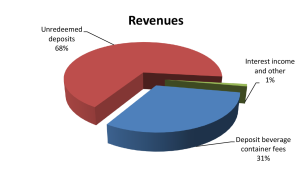

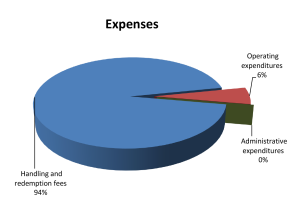

AUDITOR’S SUMMARY SECTION 342G-17, HAWAI‘I REVISED STATUTES, requires the Office of the Auditor to conduct a management and financial audit of the Department of Health’s (DOH) Deposit Beverage Container Program (Program) in fiscal years ending in even-numbered years. We contracted KMH LLP, a certified public accounting firm, to conduct this financial and program audit for the fiscal year ended June 30, 2022. Review of Prior Findings Our previous reports to the Legislature repeatedly raised concerns that DOH’s reliance on self-reported information from beverage distributors and redemption centers increases the risk of fraud, noting the parties have financial incentive to under- or over-report amounts distributors must pay into the Deposit Beverage Container Deposit Special Fund (Fund) and redemption centers may claim for reimbursement. Under the Program, distributors pay a $0.05 container fee and $0.01 handling fee per beverage into the Fund, generally passing those costs on to consumers. Consumers are reimbursed $0.05 per container at redemption centers, which in turn receive payment from the Program based on the number of containers they report as redeemed. In 2022, the Legislature passed Act 12, Session Laws of Hawai‘i, to compel DOH to develop and implement procedures to verify the accuracy and completeness of data reported by beverage distributors and redemption centers as recommended in the Office of the Auditor’s biennial reports. Act 12 requires DOH “to develop a risk-based process to help remedy the flaws in the deposit beverage container program.” Given the relatively short period of time elapsed since the issuance of our last review in December 2021 (Report No. 21-13) and the enactment of Act 12, we believed it would be unrealistic to expect DOH to already have significant and meaningful improvements in place that we could audit. Therefore, in addition to required financial information, we asked DOH to provide us with an update on the steps it has taken to improve the Deposit Beverage Container Program (Program) and implement the 2021 audit recommendations. As part of the audit, the department submitted excerpts from various action plans and additional status updates on actions taken as of August 26, 2022. We have not provided commentary on the Program’s status or findings related to the department’s action plans and status updates in this report. We appreciate that the Program has taken steps to make improvements and implement the recommendations in Report No. 21-13 and we look forward to performing a more detailed review in the future. 2023 Status Update Provided By DOH In status updates provided on August 26, 2022, the department reported that it is actively recruiting an inspector to fill out its enforcement section, as well as filling other vacancies, anticipating that full staffing will enable the department to increase the frequency of redemption center inspections from quarterly to every other month. The department has also revised its redemption center certification application for new applicants and those renewing certification. Since September 2021, applicants have been required to provide operational plans that incorporate fraud prevention procedures to ensure the collected beverage containers are secured and that receipts given to customers correlate with the deposit containers collected. In addition, the department is seeking amendments to administrative rules that are needed, for instance, to require beverage distributors to conduct independent third-party audits to verify the accuracy of their deposits and reports to the State. The department reported plans to convene an advisory committee to assist in developing any new administrative rules related to the Program as well as help update the State Integrated Solid Waste Management Plan. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2022, the Fund reported total revenues of $32.97 million and total expenditures of $27.71 million, resulting in a change in fund balance of $5.26 million. Total revenues consisted of (1) deposit beverage container fees of $10.21 million, (2) unredeemed deposits of $22.52 million, and (3) interest income and other of $245,000. Total expenditures consisted of (1) handling and redemption fees of $26.15 million, (2) operating expenditures of $1.54 million, and (3) administrative expenditures of $30,000. As of June 30, 2022, total assets were $63.15 million and total liabilities were $6.07 million. Total assets were comprised of (1) cash and cash equivalents of $57.16 million, (2) accounts receivable of $5.95 million, and (3) interest receivable of $44,000. Total liabilities were comprised of (1) vouchers and contracts payable of $4.06 million, (2) beverage container deposits of $1.95 million, (3) unearned revenue of $11,000, and (4) accrued wages and employee benefits of $45,000. Auditors’ Opinion Findings |