Financial and Compliance Audit of the Department of Education

Posted on Apr 15, 2020 in Summary|

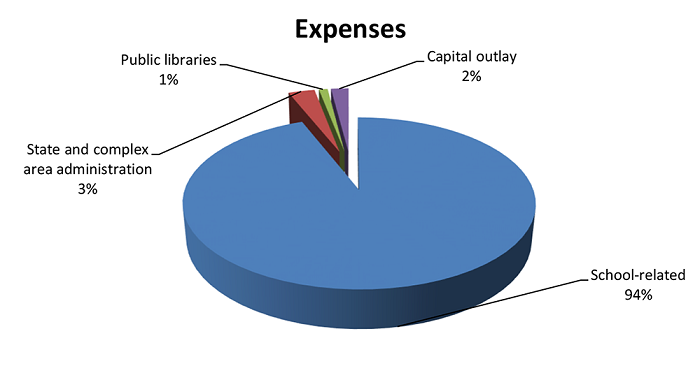

AUDITOR’S SUMMARY Financial and Compliance Audit of the Department of Education THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Education, as of and for the fiscal year ended June 30, 2019, and to comply with the requirements of Title 2 U.S. Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KKDLY LLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2019, DOE reported total revenues of $3.2 billion and total expenditures of $3.14 billion, resulting in an increase in net position of $65 million.

As of June 30, 2019, total assets exceeded total liabilities by $2.7 billion. Of this amount, $769 million is unrestricted and may be used to meet ongoing expenses and obligations. Total assets of $3.22 billion were comprised of cash of $1.23 billion, receivables of $66 million, and net capital assets of $1.93 billion. Total liabilities of $525 million were comprised of (1) vouchers and contracts payable of $134 million, (2) accrued wages and employee benefits of $152 million, (3) accrued compensated absences of $72 million, (4) workers’ compensation claims reserve of $147 million, (5) amount due to the state general fund of $5 million, and (6) notes payable of $15 million. Auditors’ Opinion DOE RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. DOE also received an unmodified opinion on its compliance with major federal programs in accordance with the Uniform Guidance. Findings THERE WERE NO REPORTED DEFICIENCIES in internal controls over financial reporting that are considered to be material weaknesses and required to be reported under Government Auditing Standards. However, the auditors identified one deficiency in internal control over financial reporting that is considered a significant deficiency. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. The deficiency is described on pages 53-55 of the report. There were no findings that are considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. However, the auditors identified one deficiency in internal control over compliance that is considered a significant deficiency. A significant deficiency in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of a federal program that is less severe than a material weakness in internal control over compliance, yet important enough to merit attention by those charged with governance. The deficiency is described on pages 56-57 of the report. |

| About the Department

The Department of Education (DOE) administers the statewide system of public schools and public libraries. DOE is also responsible for administering state laws regarding regulation of private school operations through a program of inspection and licensing and the professional certification of all teachers for every academic and noncollege type of school. Federal grants received to support public school and public library programs are administered by DOE on a statewide basis. |