Financial and Compliance Audit of the Department of Hawaiian Home Lands

Posted on Apr 10, 2024 in Summary|

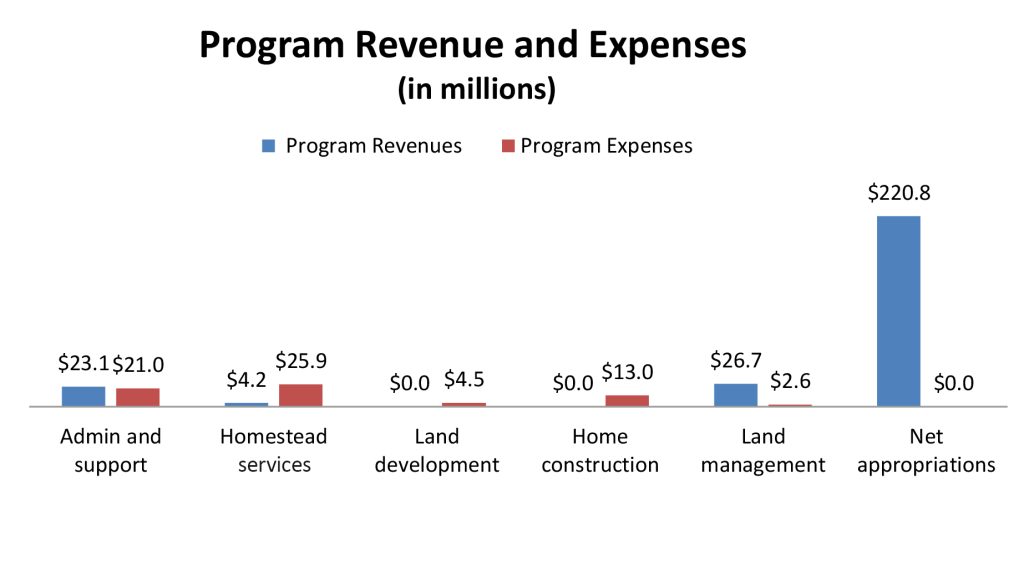

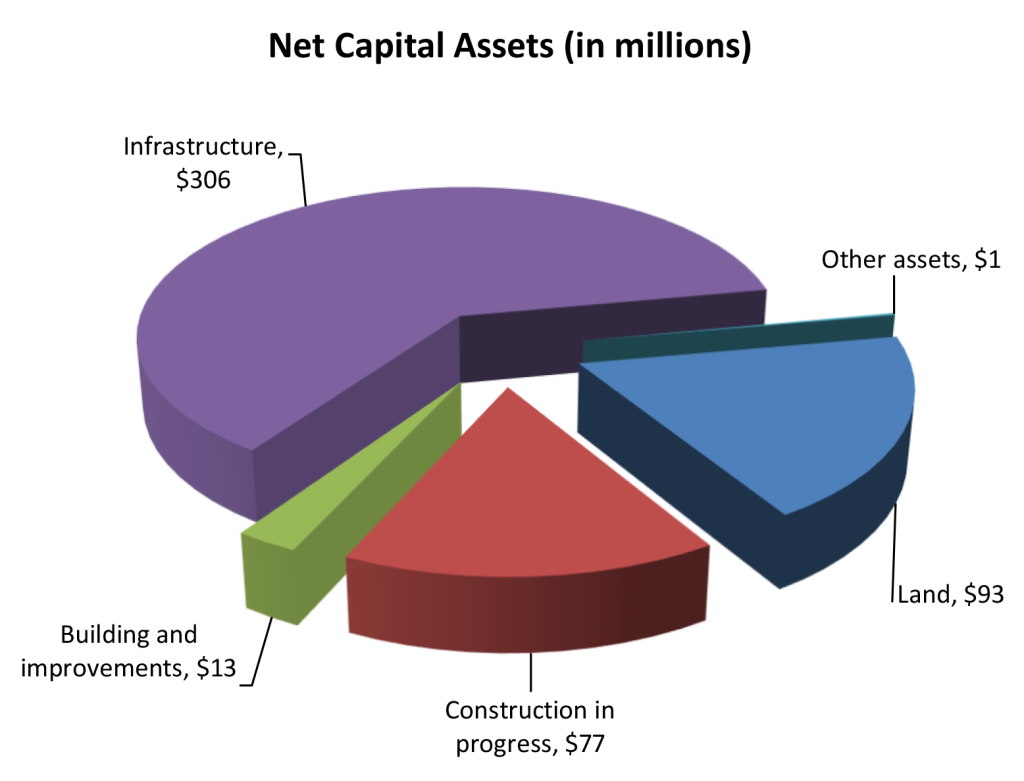

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2023 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Hawaiian Home Lands, as of and for the fiscal year ended June 30, 2023, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by Akamine, Oyadomari & Kosaki CPA’s, Inc. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2023, DHHL’s total revenues exceeded total expenses As of June 30, 2023, total assets of $1.54 billion exceeded total liabilities of $398 million, resulting in a net position balance of $1.1 billion. Total assets included net capital assets of $490 million, cash of $623 million, loans receivable of $91 million, and other assets and deferred outflows of resources of $334 million. Loans receivable consisted of 1,251 loans made to native Hawaiian lessees for the purposes specified in the Hawaiian Homes Commission Act. Loans are for a maximum amount of approximately $452,000 and for a maximum term of 40 years. Interest rates on outstanding loans range up to 10 percent. Total liabilities included bonds and lease liabilities totaling $44 million and temporary deposits payable and other liabilities of $354 million. Auditors’ Opinions Findings |

| About the Department

The Hawaiian Homes Commission Act sets aside certain public lands as Hawaiian home lands to be utilized in the rehabilitation of native Hawaiians. These public lands are managed by the Department of Hawaiian Home Lands (DHHL), a state agency headed by the Hawaiian Homes Commission, whose primary responsibilities are to serve its beneficiaries and to manage this extensive land trust. DHHL provides direct benefits to native Hawaiians in the form of 99-year homestead leases at $1 per year for residential, agricultural, or pastoral purposes, and financial assistance through direct loans, insured loans, or loan guarantees for home purchase, construction, home replacement, or repair. In addition to administering the homesteading program, DHHL leases trust lands not in homestead use at market value and issues revocable permits, licenses, and rights-of-entry. Its financial statements include the public trusts controlled by the Hawaiian Homes Commission. |