Financial and Compliance Audit of the Department of Human Services

Posted on Apr 17, 2020 in Summary|

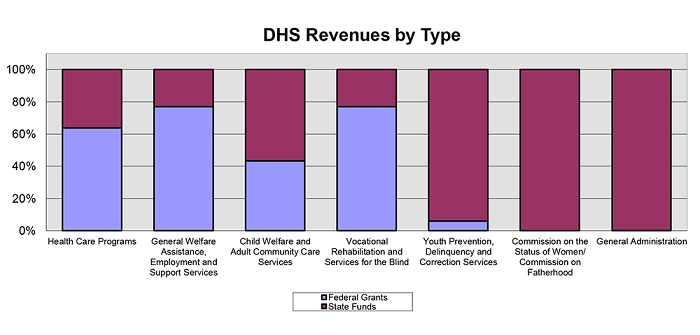

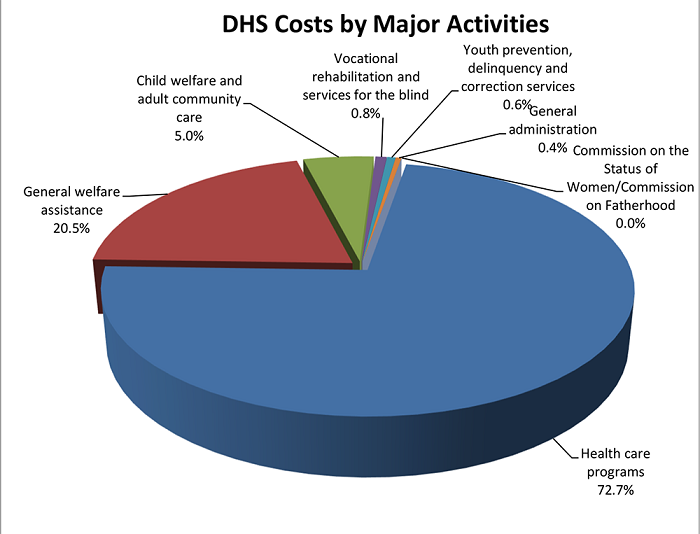

AUDITOR’S SUMMARY Financial and Compliance Audit of the Department of Human Services THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Human Services, as of and for the fiscal year ended June 30, 2019, and to comply with Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KMH LLP. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2019, DHS reported total revenues of $3.42 billion and total expenses of $3.46 billion. Revenues consist of $1.21 billion in state allotments, net of lapsed amounts plus non-imposed employee fringe benefits, and $2.21 billion in operating grants from the federal government. Revenues from these federal grants paid for 63.8 percent of the cost of DHS’ activities.

As of June 30, 2019, DHS’ total assets of $593 million included (1) cash of $369 million, (2) receivables of $154 million, and (3) net capital assets of $70 million. Total liabilities of $328 million included (1) vouchers payable of $22 million, (2) accrued wages and employee benefits of $27 million, (3) amounts due to the state general fund of $197 million, (4) accrued medical assistance payable of $68 million, and (5) accrued compensated absences of $14 million. Auditors’ Opinion DHS RECEIVED AN UNMODIFIED OPINION that its financial statements are presented fairly, in all material respects, in accordance with generally accepted accounting principles. DHS received a qualified opinion on its compliance for all major federal programs, except for Foster Care – Title IV-E, Social Services Block Grant and Disability Insurance/SSI Cluster, which received an unmodified opinion in accordance with the Uniform Guidance. Findings THERE WAS ONE SIGNIFICANT DEFICIENCY in internal controls over financial reporting that is required to be reported under Government Auditing Standards. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. The significant deficiency is described on pages 76-77 of the report. There were 13 material weaknesses in internal control over compliance that are required to be reported in accordance with the Uniform Guidance. A material weakness in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance, such that there is a reasonable possibility that material noncompliance with a type of compliance requirement of a federal program will not be prevented or detected and corrected on a timely basis. The material weaknesses are described on pages 78-99 of the report. |

| About the Department

The Department of Human Services (DHS) works to provide benefits and services to individuals and families in need. The majority of DHS’ budget is comprised of federal funds. DHS’ mission is to direct its funds toward protecting and helping those least able to care for themselves and to provide services designed toward achieving self-sufficiency for clients as quickly as possible. Activities include health care programs; general welfare assistance, employment and support services; child welfare and adult community care services; vocational rehabilitation and services for the blind; youth prevention, delinquency and correction services; and general administration. Attached programs include the Commission on the Status of Women and Commission on Fatherhood. |