Financial and Compliance Audit of the Department of Human Services

Posted on Apr 8, 2022 in Summary|

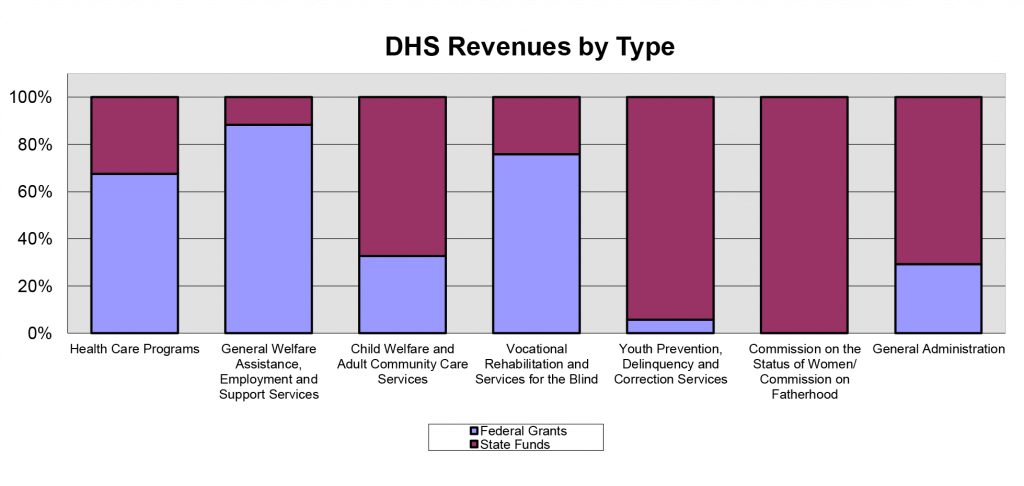

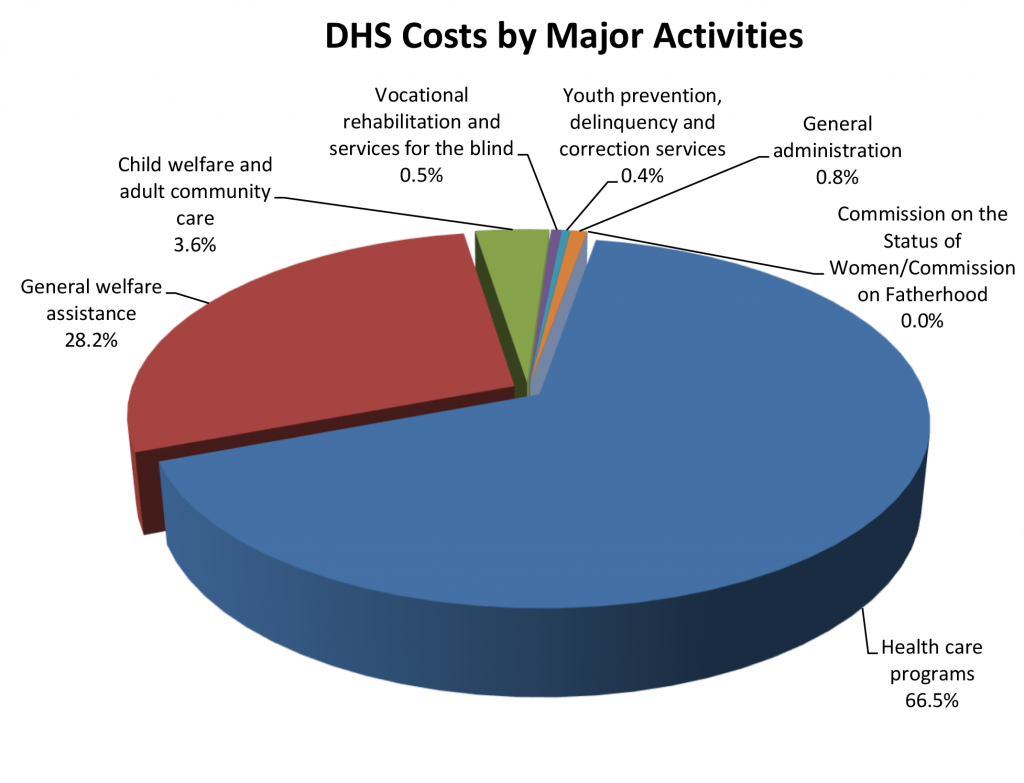

AUDITOR’S SUMMARY Financial and Compliance Audit of the Department of Human Services THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Human Services, as of and for the fiscal year ended June 30, 2021, and to comply with Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KMH LLP. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2021, DHS reported total revenues of $4.62 billion and total expenses of $4.66 billion. Revenues consisted of $1.31 billion in state allotments, net of lapsed amounts plus non-imposed employee fringe benefits, and $3.31 billion in operating grants from the federal government. Revenues from these federal grants paid for 70.7 percent of the cost of DHS’ activities.

As of June 30, 2021, DHS’ total assets of $560 million included (1) cash of $257 million, (2) receivables of $223 million, and (3) net capital assets of $80 million. Total liabilities of $383 million included (1) vouchers payable of $28 million, (2) accrued wages and employee benefits of $20 million, (3) amounts due to the state general fund of $218 million, (4) accrued medical assistance payable of $101 million, and (5) accrued compensated absences of $16 million. Auditors’ Opinions DHS RECEIVED AN UNMODIFIED OPINION that its financial statements are presented fairly, in all material respects, in accordance with generally accepted accounting principles. DHS received a qualified opinion on its compliance for all major federal programs, except for Coronavirus Relief Fund and Pandemic EBT Food Benefits, which received an unmodified opinion in accordance with the Uniform Guidance. Findings THE AUDITORS IDENTIFIED a material weakness in internal control over financial reporting that was required to be reported under Government Auditing Standards. A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis. The material weakness is described on pages 73-74 of the report. There were 15 material weaknesses in internal control over compliance that were required to be reported in accordance with the Uniform Guidance. A material weakness in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance, such that there is a reasonable possibility that material noncompliance with a type of compliance requirement of a federal program will not be prevented or detected and corrected on a timely basis. The material weaknesses are described on pages 75-103 of the report. There was one significant deficiency in internal control over compliance that was required to be reported in accordance with the Uniform Guidance. A significant deficiency in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of a federal program that is less severe than a material weakness in internal control over compliance, yet important enough to merit attention by those charged with governance. The deficiency is described on pages 106-107 of the report. There was one finding of known questioned costs when likely questioned costs are greater than $25,000 that was required to be reported in accordance with the Uniform Guidance. The finding is described on pages 104-105 of the report. |

| About the Department

The Department of Human Services (DHS) works to provide benefits and services to individuals and families in need. The majority of DHS’ revenue is comprised of federal funds. DHS’ mission is to direct its funds toward protecting and helping those least able to care for themselves and to provide services designed toward achieving self-sufficiency for clients as quickly as possible. Activities include health care programs; general welfare assistance, employment and support services; child welfare and adult community care services; vocational rehabilitation and services for the blind; youth prevention, delinquency and correction services; and general administration. Attached programs include the Hawai‘i State Commission on the Status of Women and the Hawai‘i State Commission on Fatherhood. |