Financial and Compliance Audit of the Department of the Attorney General

Posted on Feb 29, 2024 in Summary|

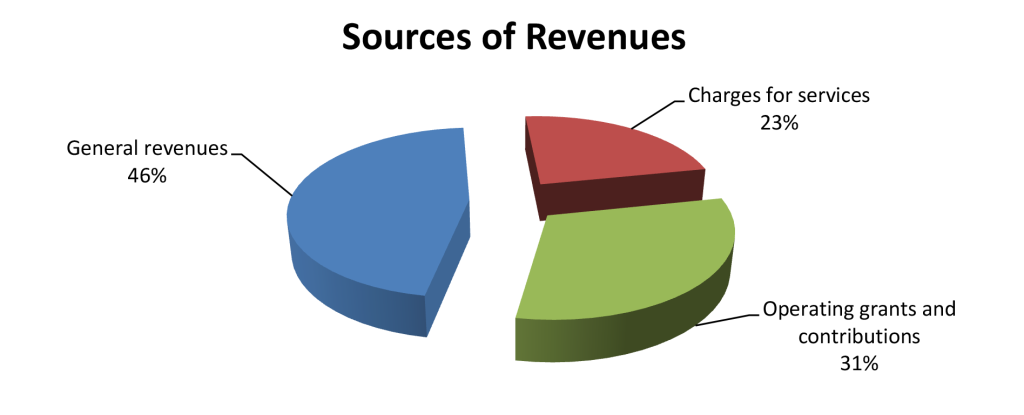

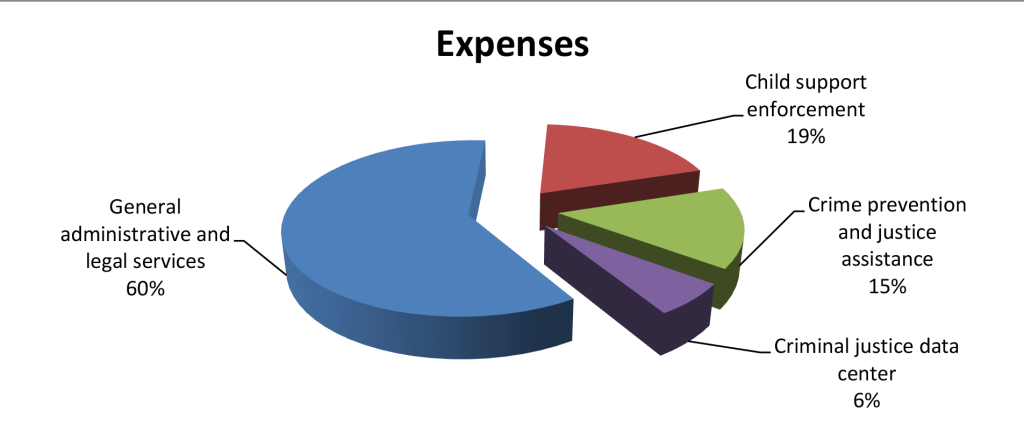

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2022 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of the Attorney General, as of and for the fiscal year ended June 30, 2022, and to comply with the requirements of Title 2 U.S. Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KKDLY LLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2022, AG reported total revenues of $107.1 million and total expenses of $99.1 million, resulting in an increase in net position of approximately $8 million. Revenues include general revenues of $49 million, primarily state appropriations; program revenues consisting of charges for services of $24.4 million; and operating grants and contributions of $33.7 million. Expenses of $99.1 million consisted of (1) $59.3 million for general administrative and legal services; (2) $19.3 million for child support enforcement; (3) $14.3 million for crime prevention and justice assistance; and (4) $6.2 million for criminal justice data center activities. Auditors’ Opinions Findings THERE WERE NO FINDINGS that were considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. However, the auditors identified a significant deficiency in internal control over compliance. A significant deficiency in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of a federal program that is less severe than a material weakness in internal control over compliance, yet important enough to merit attention by those charged with governance. The significant deficiency is described on pages 66-67 of the report. |

| About the Department

The Department of the Attorney General (AG) provides legal services to the executive, legislative, and judicial branches of Hawai‘i State government, including furnishing formal and informal legal opinions to the Governor, Legislature, and heads of Hawai‘i State departments and offices and approving documents relating to the acquisition of lands and interests by the State. AG also maintains criminal justice information, conducts investigations, operates crime prevention programs, and represents the State of Hawai‘i in legal proceedings. AG’s Child Support Enforcement Agency provides assistance to children by locating parents, establishing paternity and support obligations, and enforcing those obligations. |