Financial and Compliance Audit of the Department of Transportation, Administration Division

Posted on Mar 24, 2025 in Summary|

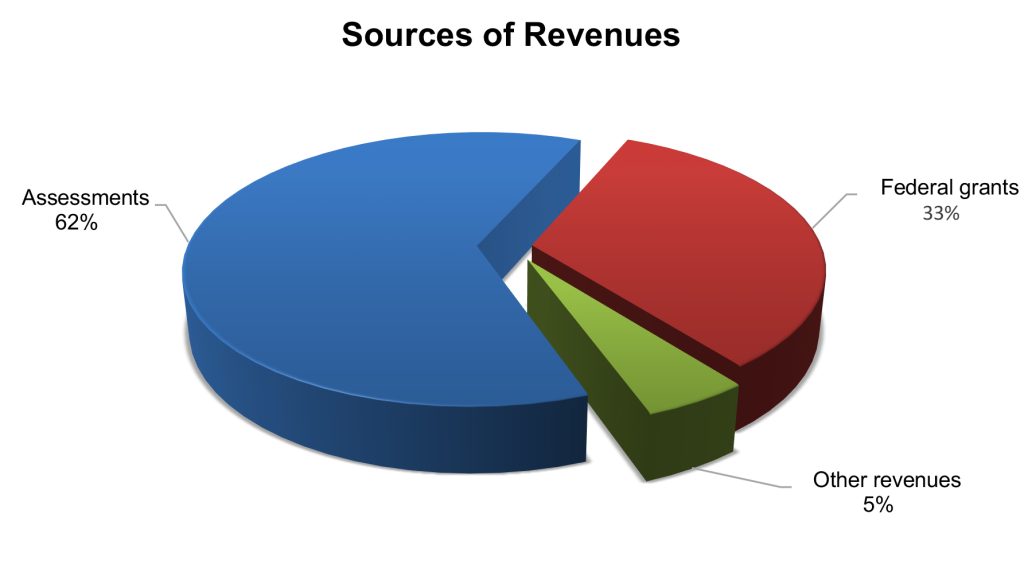

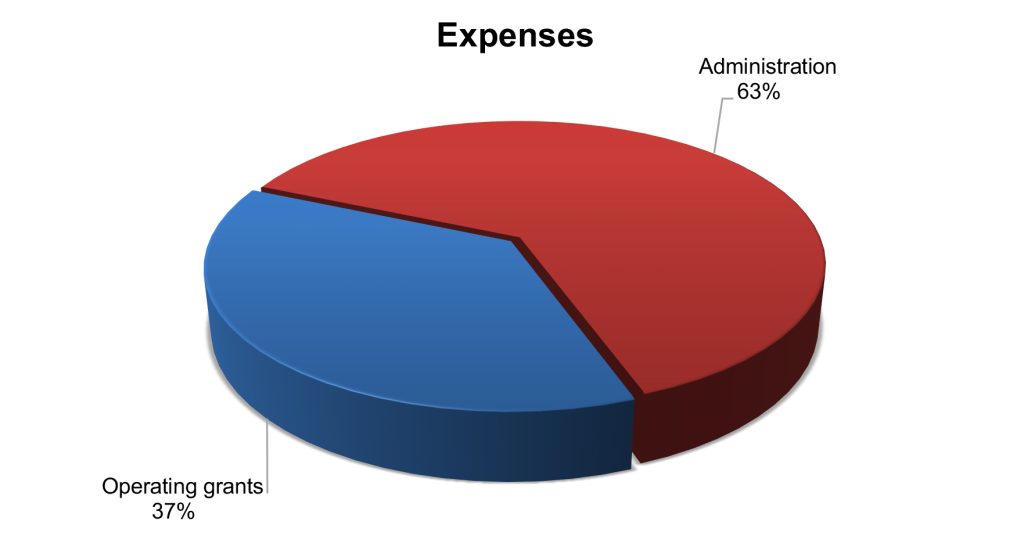

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2024 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements of the Department of Transportation, Administration Division, as of and for the fiscal year ended June 30, 2024, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KKDLY LLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2024, DOT–Administration reported total revenues of $42.6 million, total expenses of $38.3 million, and net transfers of $8.1 million, resulting in a decrease in net position of $3.8 million. Revenues consisted of $26.4 million from assessments, $14.2 million from federal grants, and $2 million from other revenue sources. Total expenses of $38.3 million consisted of $14.2 million for operating grants and $24.1 million for administration. As of June 30, 2024, total assets of $49.2 million were comprised of (1) cash of $17.8 million, Auditors’ Opinions DOT—ADMINISTRATION RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. DOT–Administration also received an unmodified opinion on its compliance with major federal programs in accordance with the Uniform Guidance. Findings THERE WERE NO REPORTED DEFICIENCIES in internal control over financial reporting that were considered to be material weaknesses and no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards. There were no findings that were considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. However, the auditors identified one significant deficiency in internal controls over compliance that was required to be reported under the Uniform Guidance. A significant deficiency in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of a federal program that is less severe than a material weakness in internal control over compliance, yet important enough to merit attention by those charged with governance. The significant deficiency is described on pages 63-64 of the report. Audit reports for the Department’s Airports Division, Harbors Division, and Highways Division are available on our website. |

| About the Division

The State Department of Transportation is comprised of four divisions (Airports, Harbors, Highways, and Administration). The Administration Division (DOT–Administration) includes the Office of the Director of Transportation, the Statewide Transportation Planning Office, and Departmental Staff Services Offices. Collectively, these offices provide overall administrative support for the Department of Transportation. The financial statements for the Division reflect the financial activities of DOT–Administration and the Aloha Tower Development Corporation, which is attached to the Department for administrative purposes. DOT–Administration receives a percentage of the Airports, Harbors, and Highways Divisions’ state-allotted appropriations to cover general administration expenses. The Department’s Statewide Transportation Planning Office administers certain Federal Transit Administration and Federal Highway Administration grants. |