Financial and Compliance Audit of the Department of Transportation, Airport Division

Posted on Jan 23, 2024 in Summary|

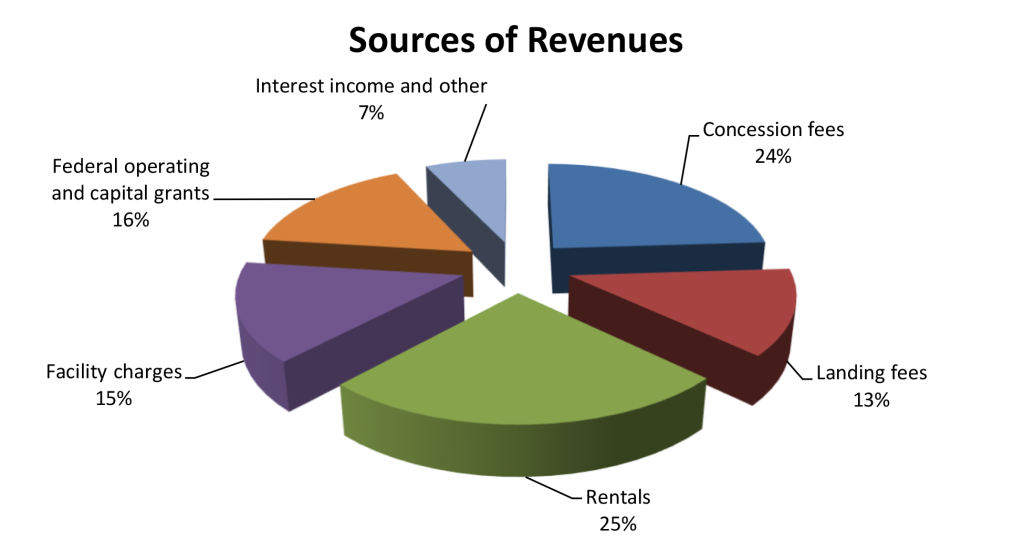

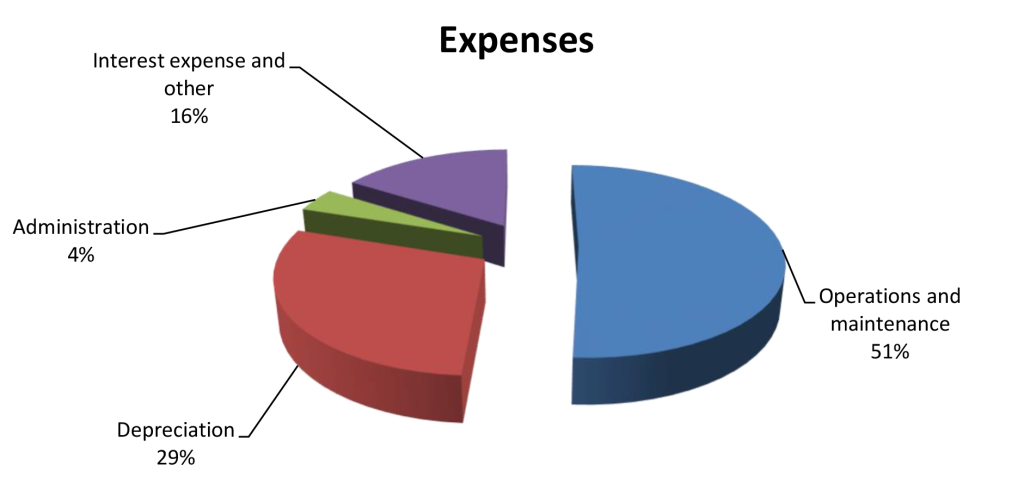

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2023 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements of the Department of Transportation, Airports Division, as of and for the fiscal year ended June 30, 2023. The audit was conducted by Plante & Moran, PLLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2023, DOT–Airports reported total revenues of $773.7 million and total expenses of $649.6 million, resulting in an increase in net position of $124.1 million. Revenues consisted of (1) $183 million in concession fees, (2) $98.2 million in landing fees, (3) $197.4 million in rentals, (4) $114.5 million in facility charges, (5) $121.4 million in federal operating and capital grants, and (6) $59.2 million in interest and other revenues. Total expenses of $649.6 million consisted of (1) $332.7 million for operations and maintenance, (2) $188.2 million in depreciation, (3) $26.1 million for administration, and (4) $102.6 million in interest and other expenses. As of June 30, 2023, the department reported total assets and deferred outflows of resources of $6.25 billion, comprised of (1) cash of $1.31 billion, (2) investments of $232 million, (3) net capital assets of $4.07 billion, and (4) $638 million in receivables, other assets, and deferred outflows of resources. Total liabilities and deferred inflows of resources totaled $3.54 billion, which includes (1) $1.9 billion in airports system revenue bonds, (2) $157 million in lease revenue certificates of participation, (3) $403 million in customer facility charge revenue bonds, and (4) $1.09 billion in other liabilities and deferred inflows of resources. Revenue bonds for DOT-Airports are rated as follows:

DOT-Airports has numerous capital projects ongoing statewide; construction-in-progress totaled $728 million at the end of the fiscal year. Auditors’ Opinions DOT-AIRPORTS RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. Findings THE AUDITORS IDENTIFIED A MATERIAL WEAKNESS in internal control over financial reporting that was required to be reported under Government Auditing Standards. A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis. The material weakness identified by the auditors related to timely reconciliation and year-end closing procedures to ensure financial activity is accurately reflected in the financial statements. Management is in the process of reviewing and updating year-end procedures to ensure all transactions are properly recorded and reported prior to the start of the annual audit. There were no instances of noncompliance or other matters required to be reported under Government Auditing Standards. The Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards is reported separately and is available upon request. |

| About the Division

The Department of Transportation, Airports Division (DOT–Airports), operates and maintains 15 airports at various locations within the State of Hawai‘i as a single integrated system for management and financial purposes. Daniel K. Inouye International Airport is the principal airport in the airports system, providing facilities for interisland flights, domestic overseas flights, and international flights to destinations in the Pacific Rim. DOT–Airports is authorized to impose and collect rates and charges for the airports system services and properties to generate revenues to fund operating expenses. The Capital Improvements Program is primarily funded by airports system revenue bonds and lease revenue certificates of participation issued by DOT–Airports, federal grants, passenger facility charges, customer facility charges, and DOT–Airports revenues. |