Financial and Compliance Audit of the Department of Transportation, Airports Division

Posted on Apr 3, 2020 in Summary|

AUDITOR’S SUMMARY

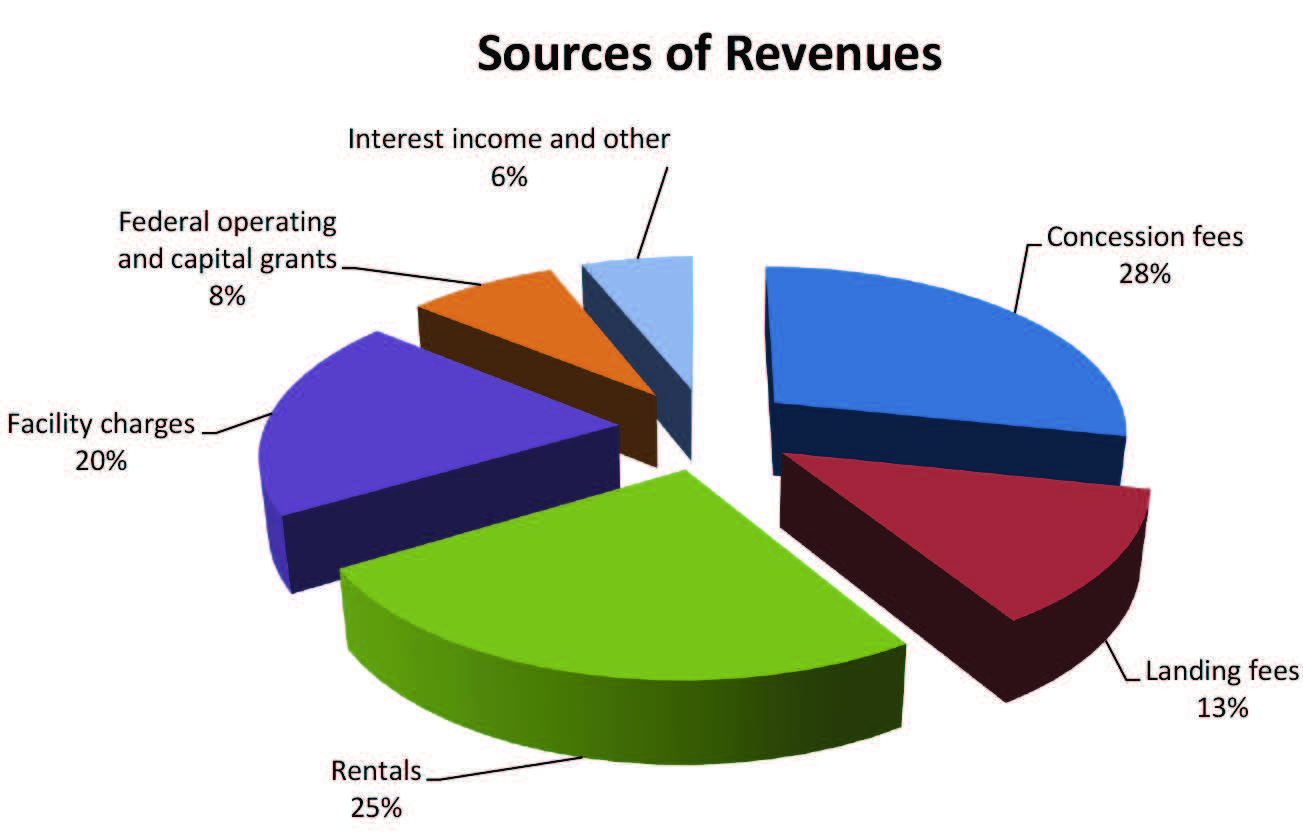

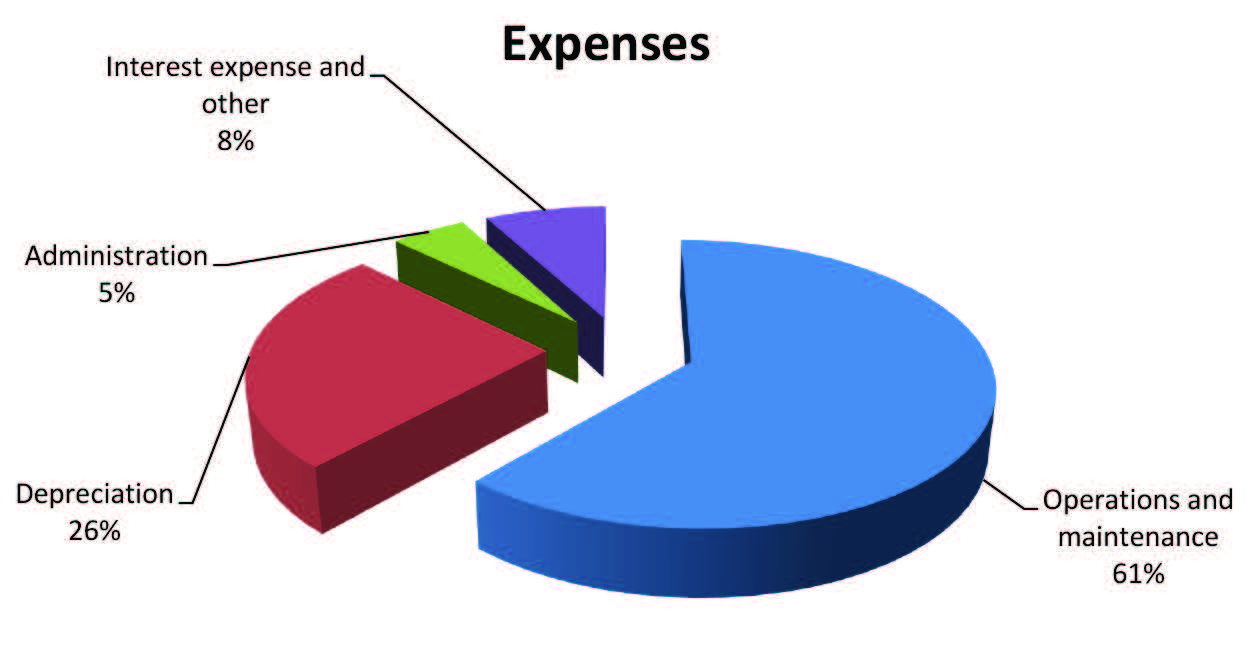

THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements of the Department of Transportation, Airports Division, as of and for the fiscal year ended June 30, 2019, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which set forth audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KPMG LLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2019, DOT-Airports reported total revenues of $646 million and total expenses of $473 million, resulting in an increase in net position of $173 million. Revenues consisted of $183 million in concession fees, $83 million in landing fees, $163 million in rentals, $126 million in facility charges, $52 million in federal operating

As of June 30, 2019, the agency reported total assets and deferred outflows of resources of $5.15 billion, comprised of (1) cash of $1.26 billion (2) investments of $304 million, (3) net capital assets of $3.43 billion, and (4) $155 million in receivables, other assets, and deferred outflows of resources. Total liabilities and deferred inflows of resources totaled $2.56 billion, which includes $1.42 billion in airports system revenue bonds, $1.11 billion in other liabilities and deferred inflows of resources, and $22 million in special facility revenue bonds.

Auditors’ Opinion DOT-AIRPORTS RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. DOT-Airports also received an unmodified opinion on its compliance with major federal programs in Findings THERE WERE NO REPORTED DEFICIENCIES in internal control over financial reporting that were considered to be material weaknesses and no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards. There were no findings that were considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. |

| About the Division

DOT—AIRPORTS operates and maintains 15 airports at various locations within the State of Hawai‘i as a single integrated system for management and financial purposes. Daniel K. Inouye International Airport is the principal airport in the airports system, providing facilities for interisland flights, domestic overseas flights, and international flights to destinations in the Pacific Rim. DOT-Airports is authorized to impose and collect rates and charges for the airports system services and properties to generate revenues to fund operating expenses. The Capital Improvements Program is primarily funded by airports system revenue bonds and lease revenue certificates of participation issued by DOT-Airports, federal grants, passenger facility charges, customer facility charges, and the DOT-Airports |