Financial and Compliance Audit of the Department of Transportation, Highways Division

Posted on Jul 13, 2020 in Summary|

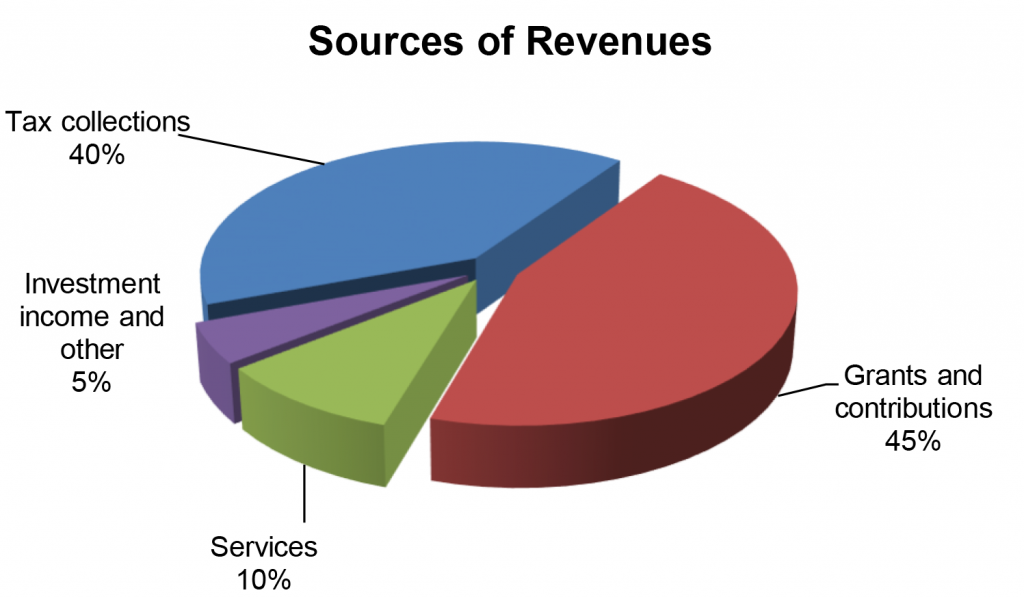

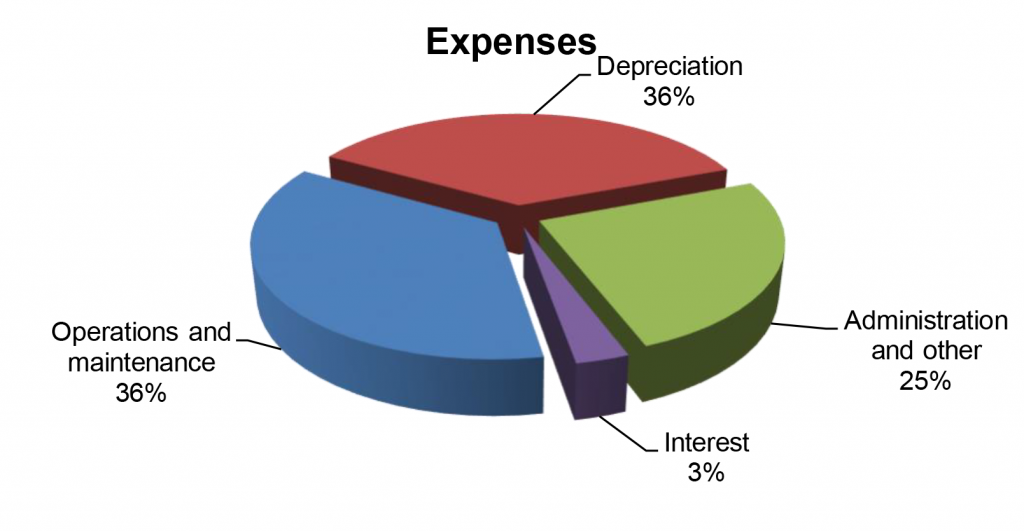

AUDITOR’S SUMMARY Financial and Compliance Audit of the Department of Transportation, Highways Division THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Transportation, Highways Division, as of and for the fiscal year ended June 30, 2019, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KKDLY LLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2019, DOT–Highways reported total revenues of $558 million and total expenses of $567 million, resulting in a decrease in net position of $9 million. Revenues consisted of (1) $225 million in tax collections; (2) $251 million in grants and contributions primarily from the Federal Highway Administration; (3) $55 million in charges for services; and (4) $27 million in investment income and other revenues.

As of June 30, 2019, total assets and deferred outflows of resources of $5.41 billion were comprised of (1) cash and investments of $329 million; (2) net capital assets of $5.03 billion; and (3) $50 million in other assets and deferred outflows of resources. Total liabilities of $606 million included $429 million in revenue bonds and $177 million in other liabilities. DOT–Highways has numerous capital projects ongoing statewide; construction in progress totaled $369 million at the end of the fiscal year. Auditors’ Opinion DOT-HIGHWAYS RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. DOT–Highways also received an unmodified opinion on its compliance with major federal programs in accordance with the Uniform Guidance. Findings THERE WERE ONE MATERIAL WEAKNESS in internal control over financial reporting that is required to be reported under Government Auditing Standards. A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented or detected and corrected on a timely basis. The reconciliation process for FY 2019 was not completed until June 16, 2020, more than eleven months after the fiscal year-end. Information about this audit and the material weakness identified by auditors is described on pages 12-16 of the single audit report. There were no findings that are considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. However, the auditors identified one deficiency in internal control over compliance that is considered a significant deficiency. A significant deficiency in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of a federal program that is less severe than a material weakness in internal control over compliance, yet important enough to merit attention by those charged with governance. The deficiency is described on pages 17-18 of the single audit report. |

| About the Division

The mission of the Department of Transportation, Highways Division (DOT–Highways), is to provide a safe, efficient, and sustainable State Highway System that ensures the mobility of people and goods within the state. The division is charged with maximizing available resources to provide, maintain, and operate ground transportation facilities and support services that promote economic vitality and livability in Hawai‘i. The Department also works with the Statewide Transportation Planning Office on innovative and diverse approaches to congestion management. |