Financial and Compliance Audit of the Department of Transportation, Highways Division

Posted on Apr 13, 2021 in Summary|

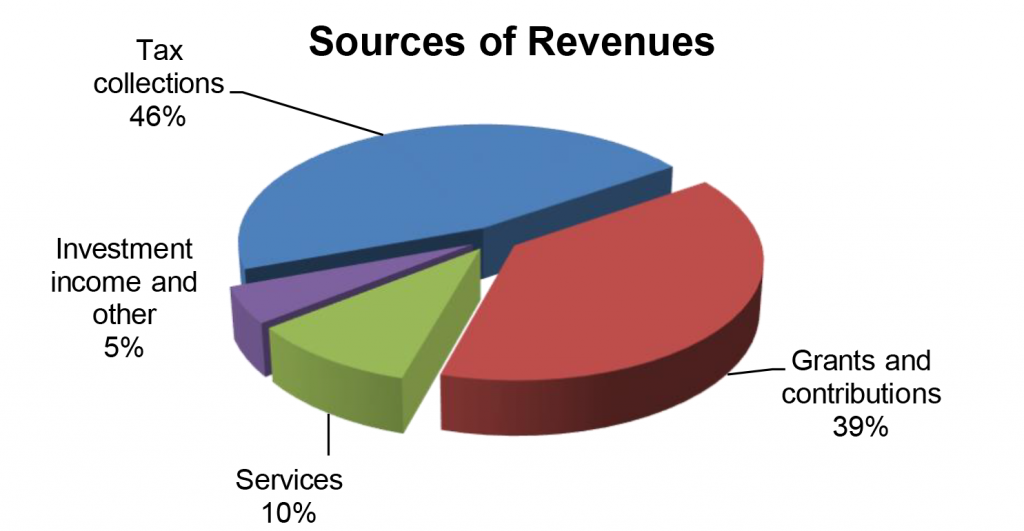

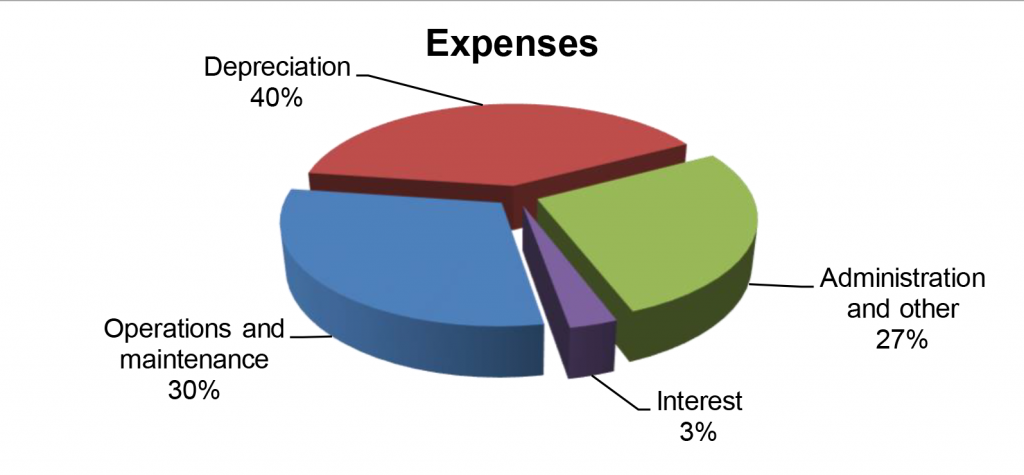

AUDITOR’S SUMMARY Financial and Compliance Audit of the Department of Transportation, Highways Division THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Transportation, Highways Division, as of and for the fiscal year ended June 30, 2020, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by KKDLY LLC. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2020, DOT-Highways reported total revenues of $491 million and total expenses of $522 million, resulting in a decrease in net position of $31 million. Revenues consisted of (1) $227 million in tax collections; (2) $190 million in grants and contributions primarily from the Federal Highway Administration; (3) $51 million in charges for services; and (4) $23 million in investment income and other revenues.

As of June 30, 2020, total assets and deferred outflows of resources of $5.44 billion were comprised of (1) cash and investments of $365 million; (2) net capital assets of $5.01 billion; and (3) $66 million in other assets and deferred outflows of resources. Total liabilities of $667 million included $493 million in revenue bonds and $174 million in other liabilities. DOT-Highways has numerous capital projects ongoing statewide; construction in progress totaled $303 million at the end of the fiscal year. Auditors’ Opinion DOT-HIGHWAYS RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. DOT-Highways also received an unmodified opinion on its compliance with major federal programs in accordance with the Uniform Guidance. Findings THERE WERE NO MATERIAL WEAKNESS in internal controls over financial reporting that were required to be reported under Government Auditing Standards. However, the auditors identified one significant deficiency in internal controls over financial reporting. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. The deficiency is described on pages 12-14 of the single audit report. There were no findings that were considered material weaknesses in internal control over compliance in accordance with the Uniform Guidance. However, the auditors identified three significant deficiencies in internal control over compliance. A significant deficiency in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of a federal program that is less severe than a material weakness in internal control over compliance, yet important enough to merit attention by those charged with governance. The deficiencies are described on pages 15-20 of the single audit report. |

| About the Division

The mission of the Department of Transportation, Highways Division (DOT-Highways), is to provide a safe, efficient, and sustainable State Highway System that ensures the mobility of people and goods within the state. The division is charged with maximizing available resources to provide, maintain, and operate ground transportation facilities and support services that promote economic vitality and livability in Hawai‘i. The Department also works with the Statewide Transportation Planning Office on innovative and diverse approaches to congestion management. |