Financial and Compliance Audit of the Hawai‘i Housing Finance and Development Corporation

Posted on Feb 2, 2023 in Summary|

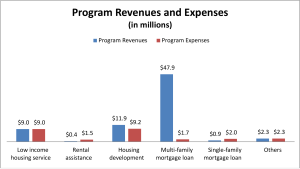

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2022 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Hawai‘i Housing Finance and Development Corporation, as of and for the fiscal year ended June 30, 2022, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which set forth audit requirements for state and local governmental units that receive federal awards. The audit was conducted by Accuity LLP. Financial Highlights HHFDC HAS TWO TYPES OF FUNDS – governmental funds and proprietary funds. HHFDC’s governmental funds are supported primarily by appropriations from the State’s General Fund, federal grants, and proceeds of the State’s general obligation bonds allotted to HHFDC. HHFDC’s governmental funds include (1) the General Fund, (2) the General Obligation Bond Fund, (3) the HOME Investment Partnership Program, (4) the Housing Trust Fund Program, and (5) the Homeowner Assistance Fund Program. HHFDC’s proprietary funds operate similar to business-type activities and are used to account for those activities for which the intent of management is to recover (primarily through user charges) the cost of providing services to customers. HHFDC’s proprietary funds include (1) the Rental Housing Revolving Fund, (2) the Dwelling Unit Revolving Fund, (3) the Single Family Mortgage Purchase Revenue Bond Fund, (4) the Housing Finance Revolving Fund, and (5) several other non-major enterprise funds. For the fiscal year ended June 30, 2022, HHFDC reported total program revenues of $72.4 million and total program expenses of $25.7 million. In addition, HHFDC reported state-allotted appropriations, net of lapses, of $65 million and a loss on disposal of capital assets of $6.4 million for the fiscal year ended June 30, 2022. Together with program revenues and expenses, this resulted in an overall increase in net position of $105.3 million. As of June 30, 2022, the agency reported total assets and deferred outflows of resources of Auditors’ Opinion Findings |

| About the Corporation

The Hawai‘i Housing Finance and Development Corporation (HHFDC) was established by the State Legislature in 2006. Its mission is to increase the state’s supply of workforce and affordable homes by providing tools and resources to facilitate housing development, such as housing tax credits, low-interest construction loans, equity gap loans, and developable land and expedited land use approvals. The agency is administratively attached to the Hawai‘i Department of Business, Economic Development and Tourism. |