Financial and Compliance Audit of the O‘ahu Metropolitan Planning Organization

Posted on Mar 20, 2020 in Summary|

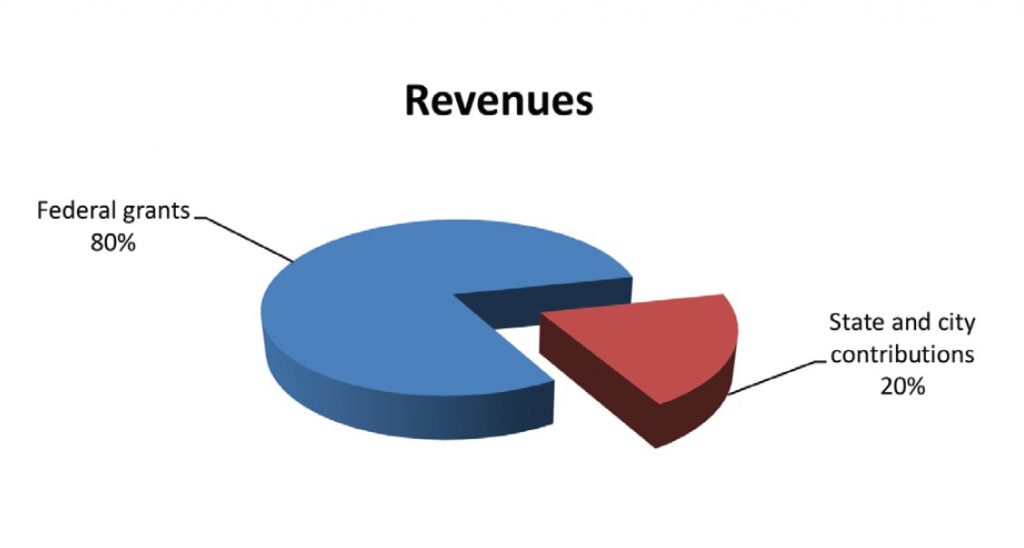

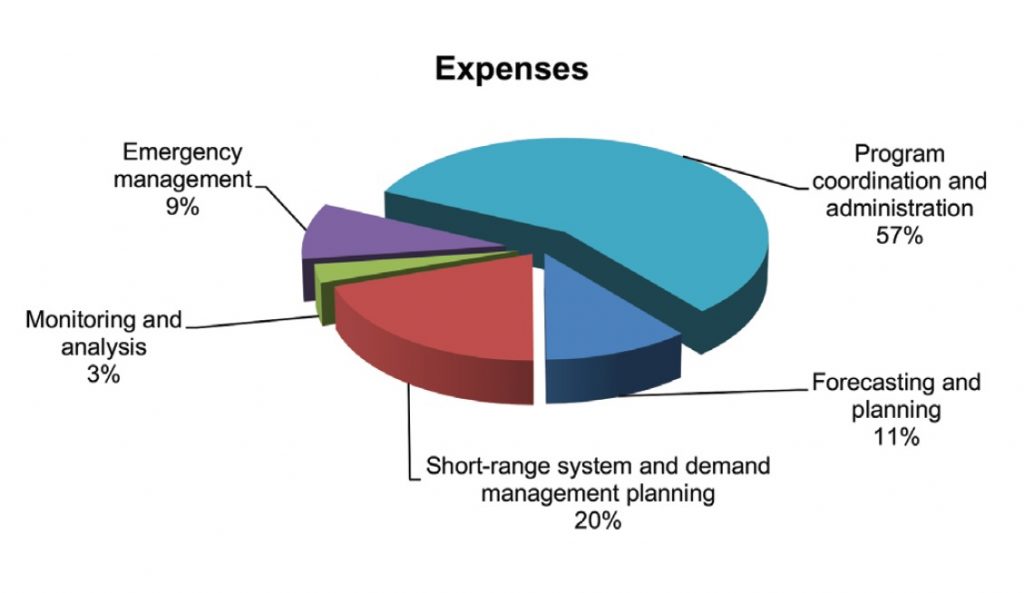

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2019 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the O‘ahu Metropolitan Planning Organization, as of and for the fiscal year ended June 30, 2019, and to comply with the requirements of Title 2, U.S. Code of Federal Regulations, Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), which established audit requirements for state and local governmental units that receive federal awards. The audit was conducted by N&K CPAs, Inc. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2019, OahuMPO reported total revenues of $2.8 million and total expenses of $2.8 million, resulting in no change in net position. Revenues consisted of $2.2 million from federal grants and $564,000 in contributions from the State of Hawai‘i and City and County of Honolulu. Total expenses consisted of: (1) $309,000 for transportation forecasting and long-range planning, (2) $568,000 for short-range transportation system and demand management planning, (3) $74,000 for transportation monitoring and analysis, (4) $262,000 for emergency management, and (5) $1.6 million for program coordination and administration. As of June 30, 2019, total assets exceeded total liabilities by $538,000. Total assets of $1.8 million included cash of $583,000 and receivables and other assets of $1.2 million. Total liabilities totaled $1.2 million. Auditors’ Opinion OahuMPO RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. OahuMPO received a qualified opinion on its compliance with major federal programs in accordance with the Uniform Guidance. Findings THERE WERE NO FINDINGS THAT WERE CONSIDERED MATERIAL WEAKNESSES in internal control over financial reporting that would have required reporting under Government Auditing Standards. The auditors identified two deficiencies in internal control over financial reporting that were considered significant deficiencies, one of which is also considered a significant deficiency in internal control over compliance. A significant deficiency is a deficiency, or a combination of The auditors identified one material weakness and one previously noted significant deficiency in internal control over compliance that are required to be reported in accordance with the Uniform Guidance. A material weakness in internal control over compliance is a deficiency, or a combination of deficiencies, in internal control over compliance, such that there is a reasonable possibility that material noncompliance with a type of compliance requirement of a federal program will not be prevented, or detected and corrected, on a timely basis. The material weakness is described on pages 48-49 of the report. |

| About the Organization

Federal highway and transit statutes require urbanized areas greater than 50,000 in population to designate a metropolitan planning organization as a condition for spending Federal highway or transit funds. O‘ahu Metropolitan Planning Organization (OahuMPO) is the designated metropolitan planning organization for the island of O‘ahu. OahuMPO was established by agreement between the Governor of the State of Hawai‘i and the Chairperson of the City Council of the City and County of Honolulu and serves as the decision making body responsible for carrying out continuing, comprehensive, and cooperative transportation planning and programming for the island of O‘ahu. |