Financial Audit of the Annual Comprehensive Financial Report of the State of Hawai‘i

Posted on Jan 6, 2022 in Summary|

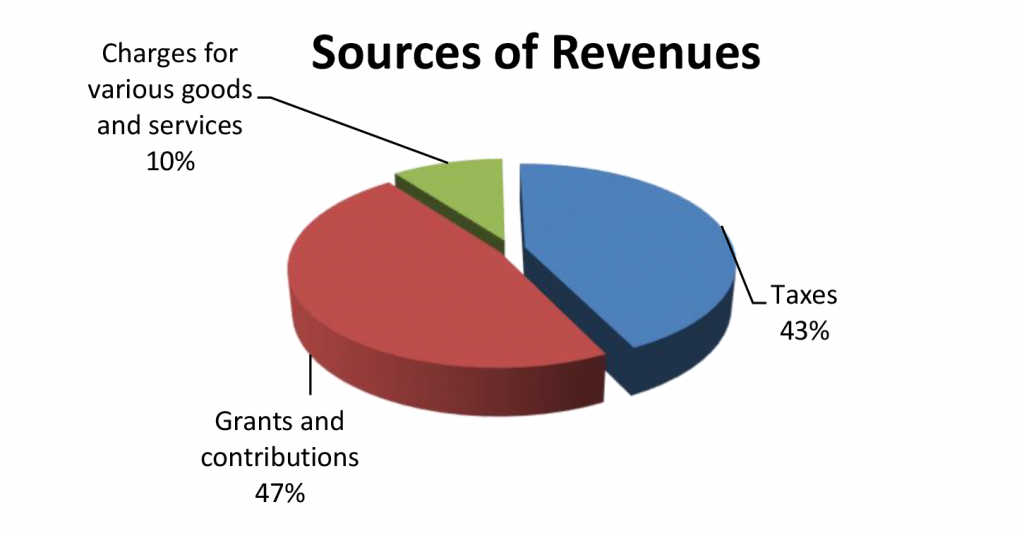

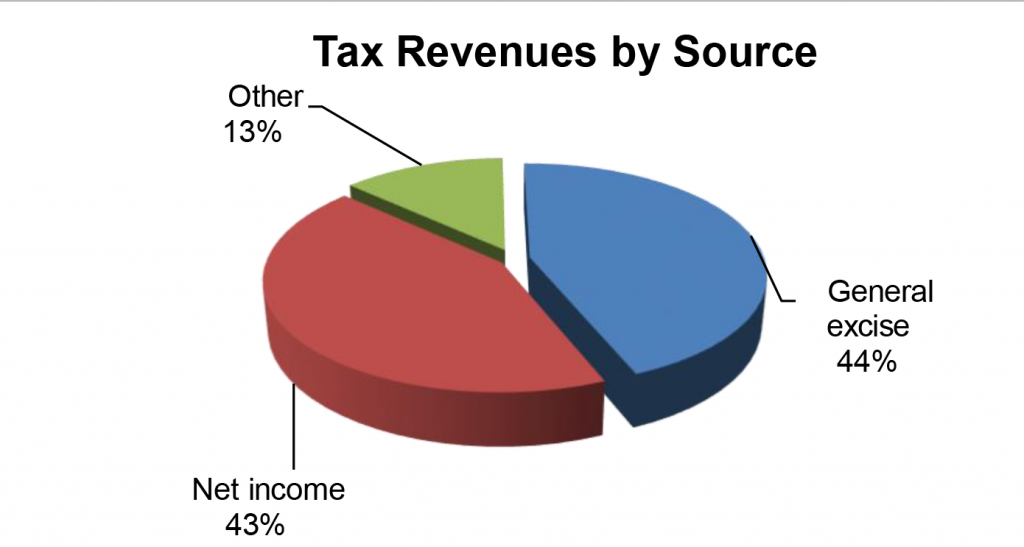

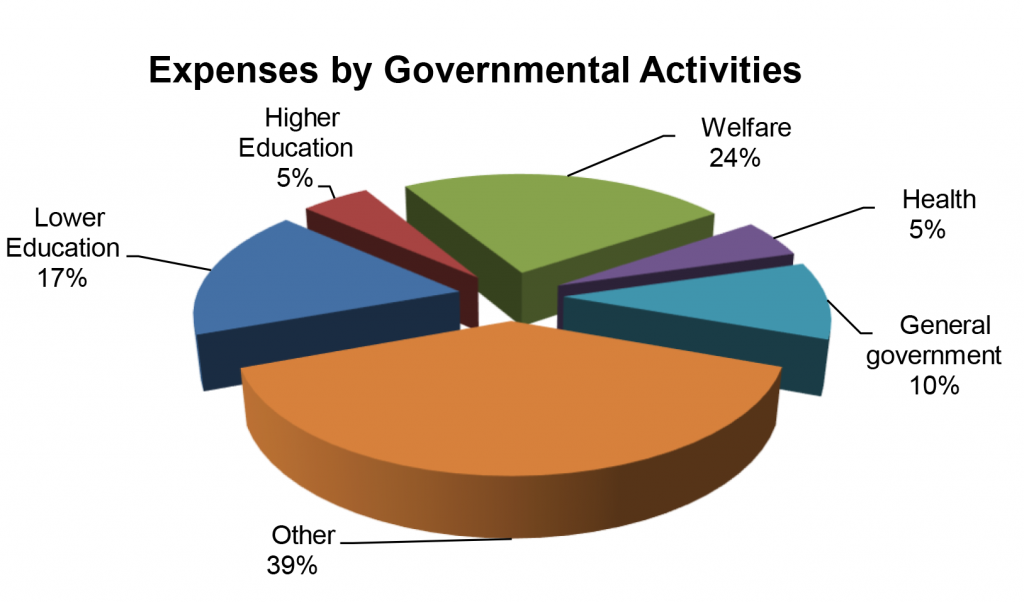

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2021 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the State of Hawai‘i’s financial statements, as presented in the Annual Comprehensive Financial Report (ACFR) for the State of Hawai‘i, as of and for the fiscal year ended June 30, 2021. The audit was conducted by Accuity LLP. The ACFR was issued on December 30, 2021. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2021, total revenues were $17.7 billion and total expenses were $19.3 billion, resulting in a decrease in net position of $1.6 billion. Approximately 43 percent of the State of Hawai‘i’s total revenues came from taxes of $7.7 billion, 47 percent from grants and contributions of $8.3 billion, and 10 percent from charges for various goods and services of $1.7 billion. Total tax revenues of $7.7 billion consisted of general excise taxes of $3.4 billion, net income taxes of $3.3 billion, and other taxes of $1 billion. The largest expenses were for welfare at $4.6 billion, lower education at $3.3 billion, higher education at $1 billion, health at $900 million, and general government at $1.9 billion. Other expenses totaled $7.6 billion. As of June 30, 2021, total liabilities and deferred inflows of resources of $32.9 billion exceeded total assets and deferred outflows of resources of $28.7 billion, resulting in a negative net position of $4.2 billion. Of this amount, $3.8 billion was for the State’s net investment in capital assets, $4.5 billion was restricted for specific programs, and a negative $12.5 billion was unrestricted assets. As of June 30, 2021, total assets and deferred outflows of resources of $28.7 billion were comprised of (1) net capital assets of $15 billion, (2) investments of $5.1 billion, (3) cash of $2.4 billion, (4) receivables of $2.1 billion, (5) restricted assets of $1.3 billion, and (6) other assets and deferred outflows of resources of $2.8 billion. Total liabilities and deferred inflows of resources of $32.9 billion were comprised of (1) general obligation and revenue bonds payable of $12.4 billion, (2) vacation and retirement benefits of $14.6 billion, and (3) other liabilities and deferred inflows of resources of $5.9 billion. Auditors’ Opinion |

| About the State

THE STATE OF HAWAI‘I is mandated by statute to provide a range of services in the areas of education (both lower and higher), welfare, transportation (including highways, airports, and harbors), health, hospitals, public safety, housing, culture and recreation, economic development, and conservation of natural resources. |