Financial Audit of the Department of Land and Natural Resources

Posted on Oct 26, 2021 in Summary|

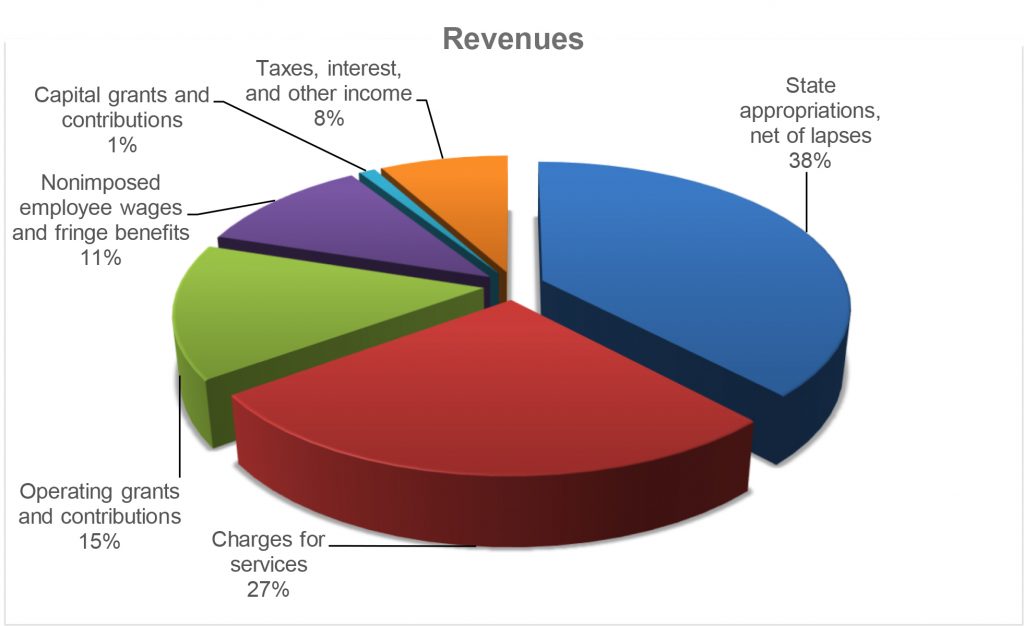

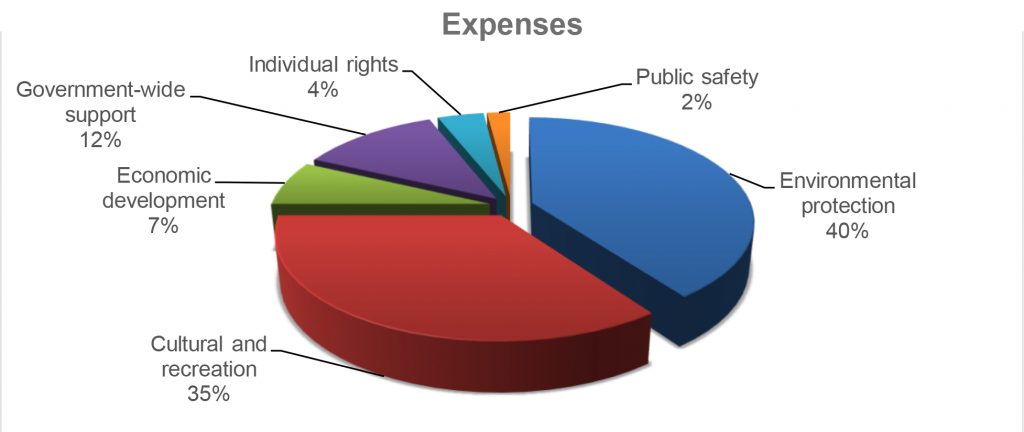

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2020 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Department of Land and Natural Resources, as of and for the fiscal year ended June 30, 2020. The audit was conducted by N&K CPAs, Inc. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2020, DLNR reported total revenues and transfers of $187.8 million and total expenses of $182.5 million, resulting in an increase in net position of $5.3 million. Revenues consisted of (1) $70.4 million from State appropriations, net of lapses, (2) $49.8 million from charges for services, (3) $27.5 million from operating grants and contributions, (4) $21 million from nonimposed employee fringe benefits, (5) $2.2 million from capital grants, and (6) $14.7 million from taxes, interest, and other income. Total transfers in amounted to $2.2 million. Total expenses of $182.5 million consisted of (1) $72.5 million for environmental protection, (2) $64 million for cultural and recreation, (3) $13.4 million for economic development, (4) $22.1 million for government-wide support, (5) $6.9 million for individual rights, and (6) $3.6 million for public safety. As of June 30, 2020, total assets of $834.4 million exceeded total liabilities of $77.7 million by $756.7 million. Total assets included cash of $295.7 million, receivables of $2.9 million, and land and net capital assets of $535.8 million. Total liabilities included vouchers and accrued payables of $30.5 million, amounts due to the State of $10.9 million, general obligation bonds payable of $32.9 million, and unearned revenues of $3.4 million. Auditors’ Opinion DLNR RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. Findings THE AUDITORS IDENTIFIED four material weaknesses in internal control over financial reporting that are required to be reported in accordance with Government Auditing Standards. A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected, on a timely basis. The material weaknesses are described on pages 73-81 of the report. The department’s corrective action plan can be found on pages 83-85. There were no instances of noncompliance or other matters that are required to be reported under Government Auditing Standards. |

| About the Department

The Department of Land and Natural Resources’ (DLNR) mission is to enhance, protect, conserve, and manage Hawai’i’s unique and limited natural, cultural and historic resources held in public trust for current and future generations of the people of Hawai’i. DLNR manages and administers the State’s parks, historical sites, forests, forest reserves, fisheries, wildlife sanctuaries, game management areas, public hunting areas, and natural area reserves and is responsible for nearly 1.3 million acres of state lands, beaches, and coastal waters as well as 750 miles of coastline. DLNR is headed by the Board of Land and Natural Resources. |