Financial Audit of the Hawai‘i Community Development Authority

Posted on Dec 28, 2021 in Summary|

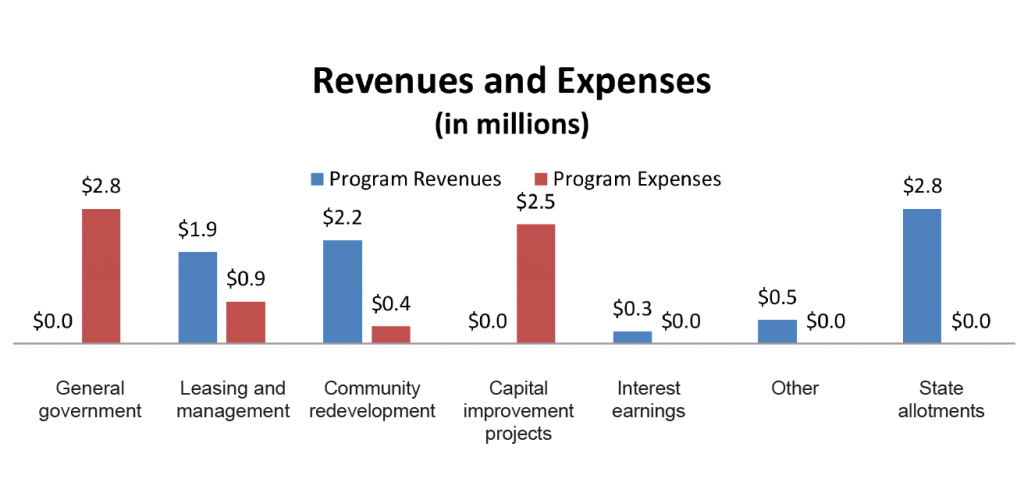

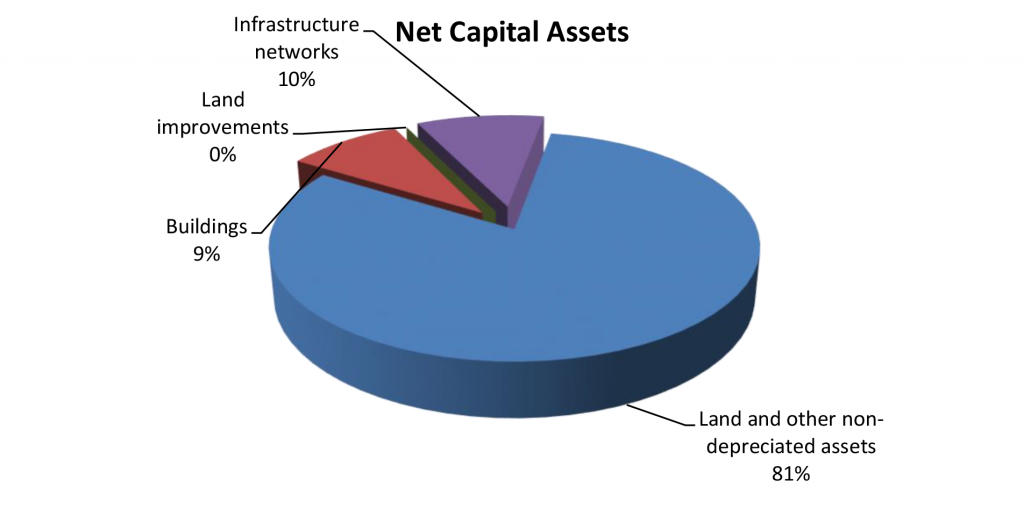

AUDITOR’S SUMMARY Financial Statements, Fiscal Year Ended June 30, 2021 THE PRIMARY PURPOSE of the audit was to form an opinion on the fairness of the presentation of the financial statements for the Hawai‘i Community Development Authority, as of and for the fiscal year ended June 30, 2021. The audit was conducted by N&K CPAs, Inc. Financial Highlights FOR THE FISCAL YEAR ended June 30, 2021, HCDA reported total revenues of $7.6 million and total expenses of $6.5 million, resulting in an increase in net position of $1.1 million. Revenues consisted of (1) leasing and management activities of $1.9 million, (2) community redevelopment activities of $2.2 million, (3) investment earnings of $300,000, (4) net state appropriations of $2.8 million, and (5) other revenue of $500,000. The following graph illustrates a comparative breakdown of HCDA’s revenues and expenses. As of June 30, 2021, total assets and deferred outflows of resources of $140.2 million exceeded total liabilities and deferred inflows of resources of $20.2 million resulting in a net position of $120 million. Of the net position balance of $120 million, $23.3 million is unrestricted and may be used to meet ongoing expenses, $2.6 million is restricted for capital projects, and $94.1 million is invested in net capital assets. The agency reported total assets and deferred outflows of resources comprised of (1) net capital assets of $94.1 million, (2) cash of $27.5 million, and (3) receivables, other assets, and deferred outflows of resources of $18.6 million. Prior Period Adjustments THE JUNE 30, 2020 FUND BALANCE/NET POSITION was restated to correct errors made in the prior period related to an understatement of liabilities of $88,000 and an overstatement of net capital assets of $46.2 million. Auditors’ Opinion HCDA RECEIVED AN UNMODIFIED OPINION that its financial statements were presented fairly, in all material respects, in accordance with generally accepted accounting principles. Findings THERE WERE NO REPORTED DEFICIENCIES in internal control over financial reporting that would have required reporting under Government Auditing Standards. The auditors identified two material weaknesses. A material weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. The material weaknesses are described on pages 68-70 of the report related to the prior period adjustments noted above. |

| About the Authority

The Hawai‘i Community Development Authority (HCDA) was established in 1976 by Chapter 206E, Hawai‘i Revised Statutes, to establish community development plans in community development districts, to determine community development programs, and to cooperate with private enterprises and various components of federal, state, and county governments to bring community plans to fruition. HCDA is administratively attached to the Department of Business, Economic Development and Tourism. |