19-08, Financial and Program Audit of the Department of Health’s Deposit Beverage Container Program, June 30, 2018

Posted on Mar 6, 2019 in SummaryBeyond Redemption: After more than a decade, the Department of Health still has not developed procedures to address the Deposit Beverage Container Program’s fundamental flaws.

| In such a flawed system without controls, there are no incentives for accurate reporting. In fact, inherent to this system are incentives to under-report the number of bottles and cash at the front end of the system and over-report the amount of bottles being recycled at the back end. |

|

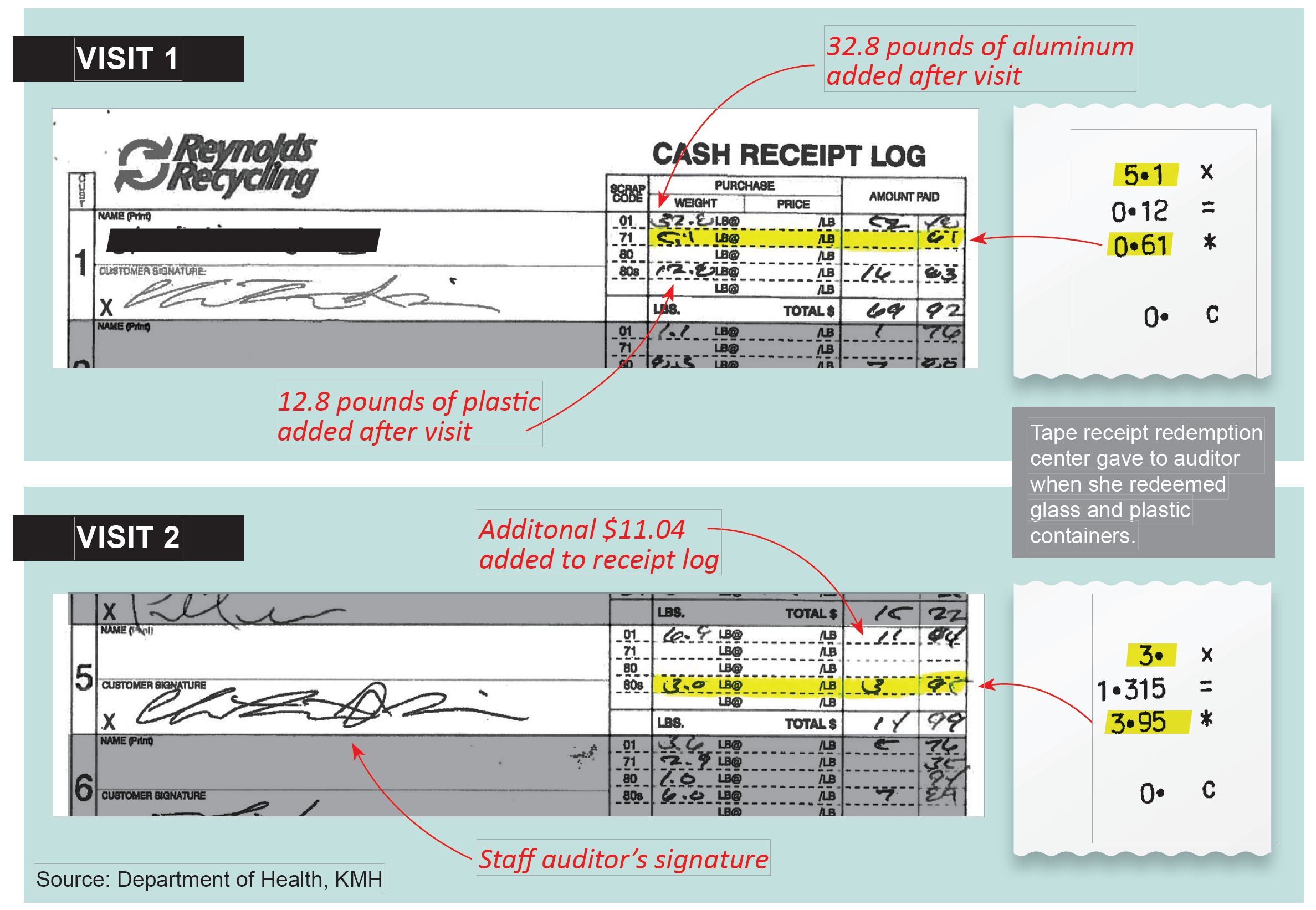

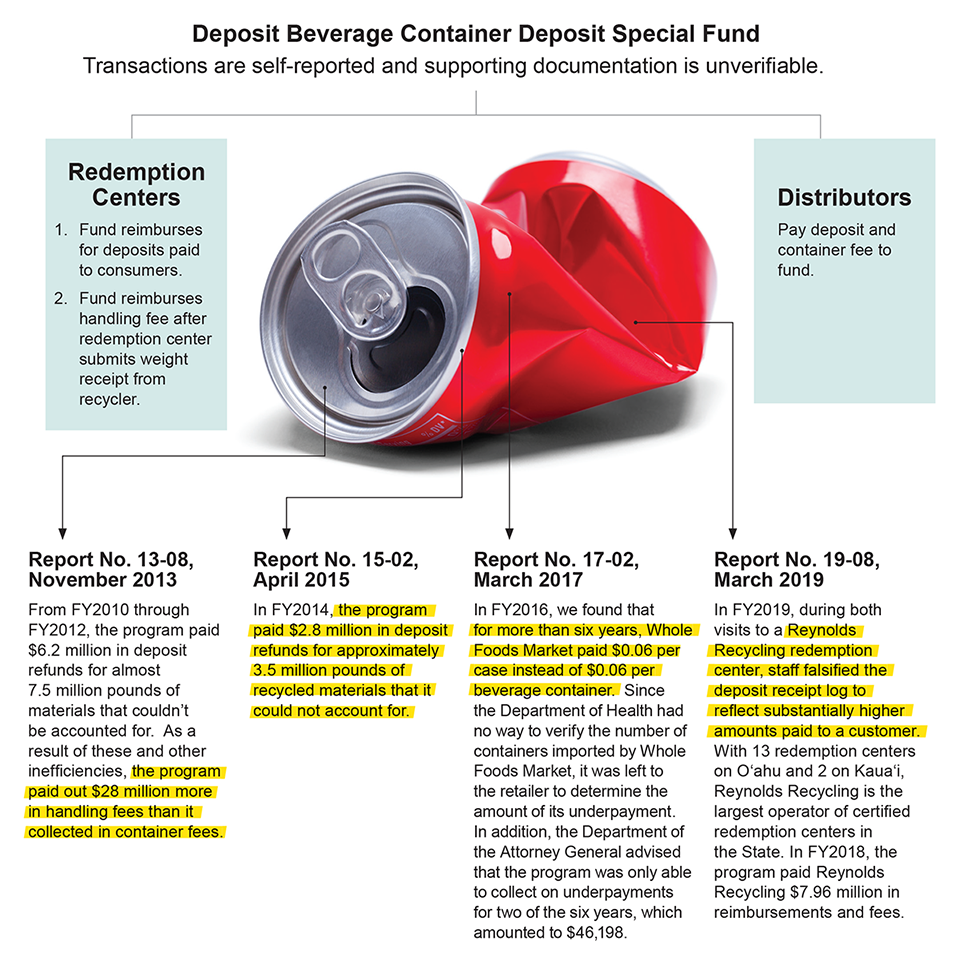

AUDITOR’S SUMMARY SECTION 342G-17, Hawai‘i Revised Statutes, requires the Office of the Auditor to conduct a management and financial audit of the Deposit Beverage Container Program in fiscal years ending in even-numbered years. We contracted KMH LLP (KMH), a certified public accounting firm, to conduct this financial and program audit for the fiscal year ended June 30, 2018. What Did We Find? As in the prior years’ audits, we found that the program has failed to develop and execute procedures to verify the accuracy and completeness of data used to support claims of the deposit and container fees paid to the program by the distributors as well as deposits and handling fees paid to the redemption centers. Without such procedures, the program relies on self-reported data and accepts that cash receipts from the distributors and payments made to redemption centers are accurate and complete. As a result, KMH’s testing found inaccuracies and possible fraudulent reporting in the data used in the aforementioned calculations. For example, during KMH’s detailed testing of 24 distributors, KMH found exceptions in six distributors’ records supporting their claims about the number of beverage containers. One distributor did not respond to KMH’s request for supporting records or schedules. Two others could not provide information on container count, container fee, and deposit amounts. As a result, KMH could not fully complete its testing. In early October 2018, KMH performed 15 unannounced visits at 10 different redemption center locations throughout the State to verify that they were in compliance with the law. In 2 of the 15 visits, the amount of money KMH was paid for redeeming recyclable materials was significantly less than the amounts recorded in the redemption center’s cash receipt log, which appeared to have been altered. DOH had reimbursed the redemption center the inflated amount. Both of the discrepancies were at the same redemption center location. Why Did These Problems Occur? The program is essentially an honor system, relying upon outside reporting by interested parties to account for the flows of bottles and cash: Beverage distributors, which are responsible for accounting for the bottles and deposits entering the system, are entrusted to self-report their own numbers as they pay into the State’s Deposit Beverage Container Deposit Special Fund accordingly. Redemption centers, responsible for both refunding deposits to consumers and reporting the number of bottles redeemed in order to collect reimbursements from the State, also self-report and are in turn paid based on those unverified numbers. In such a flawed system without controls, there are no incentives for accurate reporting. In fact, inherent to this system are incentives to under-report the number of bottles and cash at the front end of the system and over-report the amount of bottles being recycled at the back end. Why Do These Problems Matter? The program is entirely dependent upon reports from distributors and redemption centers to account for the number of containers in the system and the number of containers redeemed. The program has no way of accurately accounting for that inventory. The program has delegated accounting control of the inventory to the redemption centers and relies on an honor system, which has been repeatedly breached. At present, there is no system in place to verify the accuracy and integrity of the reports received from distributors and redemption centers. Without accurate, verifiable deposit beverage container records, the true cost of the program cannot be ascertained. Moreover, if the program is under-collecting beverage container deposits from distributors, then the program may not be financially self-sustaining; if the program is overpaying redemption claims, paying more than once for stolen and resubmitted containers, or paying handling fees for containers that are not shipped to end-use recyclers, then the cost of the program may be far more than is justified. Redemption center altered cash receipt logs to receive higher program reimbursements. IN EARLY OCTOBER 2018 KMH performed 15 unannounced visits at 10 different redemption center locations throughout the State to verify that redemption centers were in compliance with the law. KMH redeemed either aluminum, plastic, or glass containers and received a 10-key tape receipt for the money paid for the redemption. The KMH staff auditor also signed a cash receipt log, attesting to the amount of recyclable material submitted to the center and the money paid out in return. KMH waited about a month for the redemption centers to submit their Deposit Refund Request Form (DR-1) to the program for reimbursement. KMH then had program management request the detailed support for the respective DR-1 from the redemption centers. KMH found that in 2 out of 15 redemption center visits, the amounts provided in the cash receipt log did not match the amount KMH was paid. Both of the discrepancies were at the Reynolds Recycling location at 1106 University Avenue. On October 2, 2018, KMH’s staff auditor redeemed glass bottles, which the redemption center determined weighed 5.1 pounds. The staff auditor was paid $0.61. However, after the visit, 32.8 pounds of aluminum cans and 12.8 pounds of plastic containers were added to the cash receipt log, adding $52.48 and $16.83 respectively to the total. As a result, instead of $0.61, the redemption center requested and was reimbursed $69.31 by the State. Two days later, on October 4, 2018, the staff auditor redeemed plastic containers, which the redemption center determined weighed three pounds. The staff auditor was paid $3.95, but 6.9 pounds of aluminum cans were added to the cash receipt log, which added $11.04 to the total. The redemption center was reimbursed $14.99 instead of $3.95. With 13 redemption centers on O‘ahu and 2 on Kaua‘i, Reynolds Recycling is the largest operator of certified redemption centers in the State. In FY2018, the State paid Reynolds Recycling approximately $7.96 million in reimbursements and fees. |

| A Leaky, Open-ended System

The Hawai‘i Regulatory Licensing Reform Act requires the Auditor DEPOSIT AND FEE COLLECTIONS from distributors, as well as payments to certified redemption centers, are based on self-reported and unverified numbers. These fundamental weaknesses to the program’s deposit and redemption process are exacerbated by limited inspections and other procedures, which would prevent or detect whether distributors are fraudulently or erroneously under-reporting beverage containers distributed, and whether redemption centers are fraudulently or erroneously over-reporting those redeemed. In three out of four of our latest audits, we found such discrepancies. The Department of Health has been aware of this flawed payment system since 2006, but has done little to address it either with changes to the program or through enforcement inspections. |